- EUR/USD is trading near three-day lows as the Greenback is progressively recovering.

- The Brexit uncertainties are weighing on the market mood and the Fiber.

- The major macroeconomic news of the week is the European Central Bank (ECB) interest rate decision on Thursday.

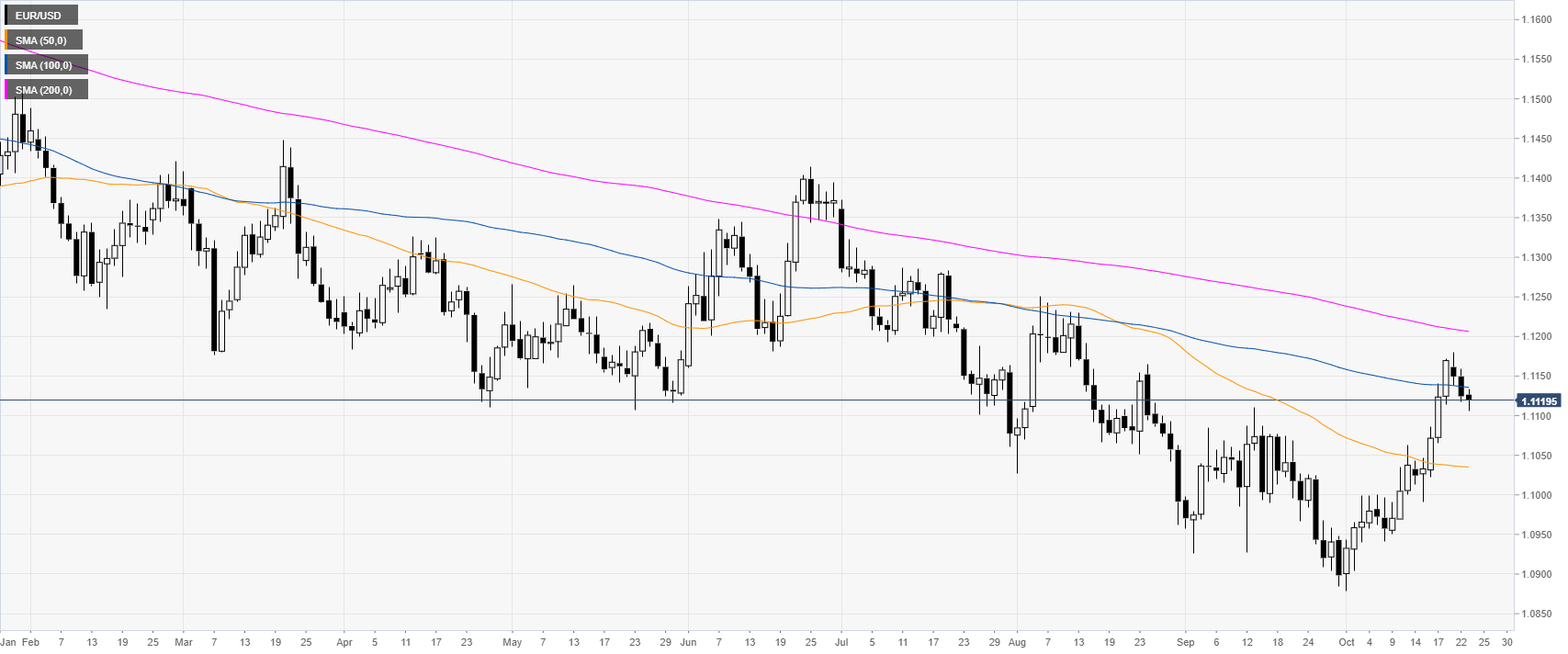

EUR/USD daily chart

On the daily chart, the common currency is trading in a bear trend below its 100 and 200-day simple moving averages (DSMAs). Traders will be focusing on the key macroeconomic event of the week: the European Central Bank (ECB) interest rate decision on Thursday.

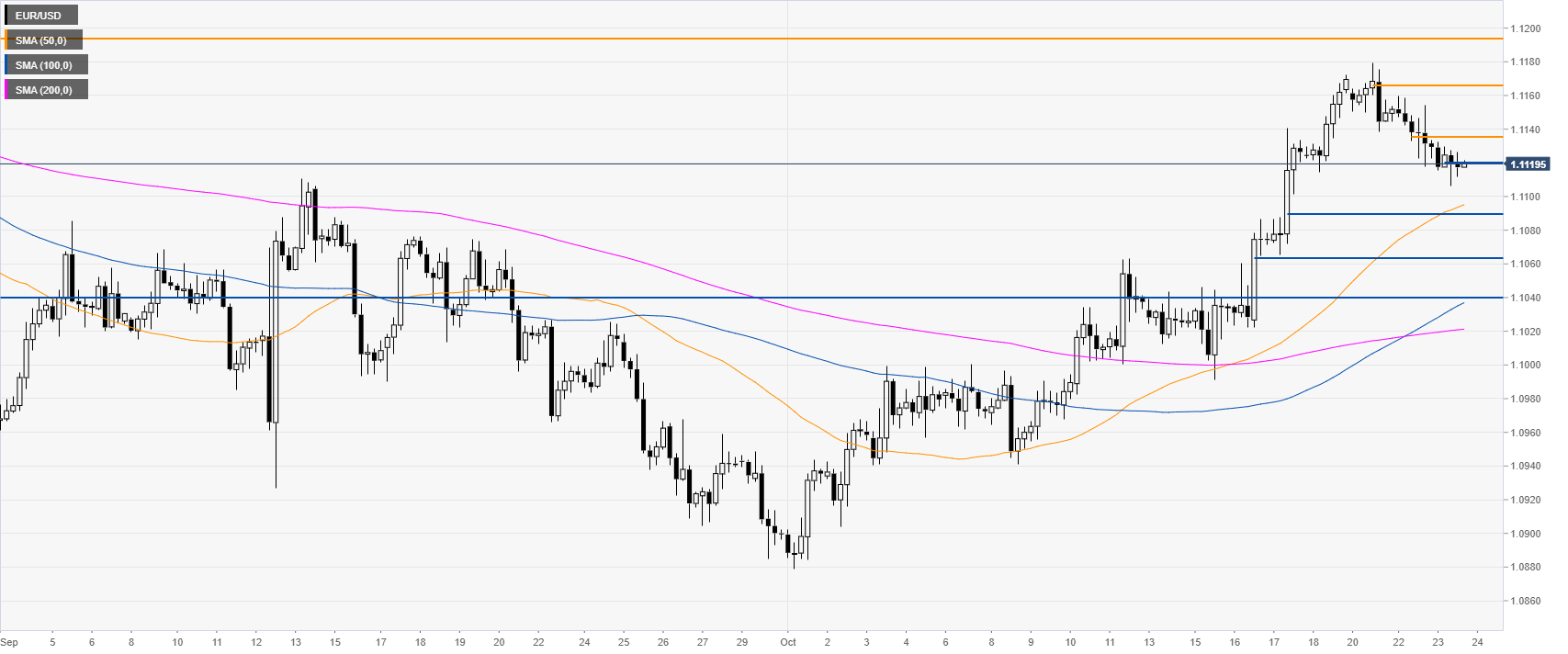

EUR/USD four-hour chart

The Euro, on the four-hour chart, is pulling back down from the October highs, trading below the 1.1140 level. As the market is softening, the retracement down could continue towards the 1.1090 and 1.1065 price levels, according to the Technical Confluences Indicator.

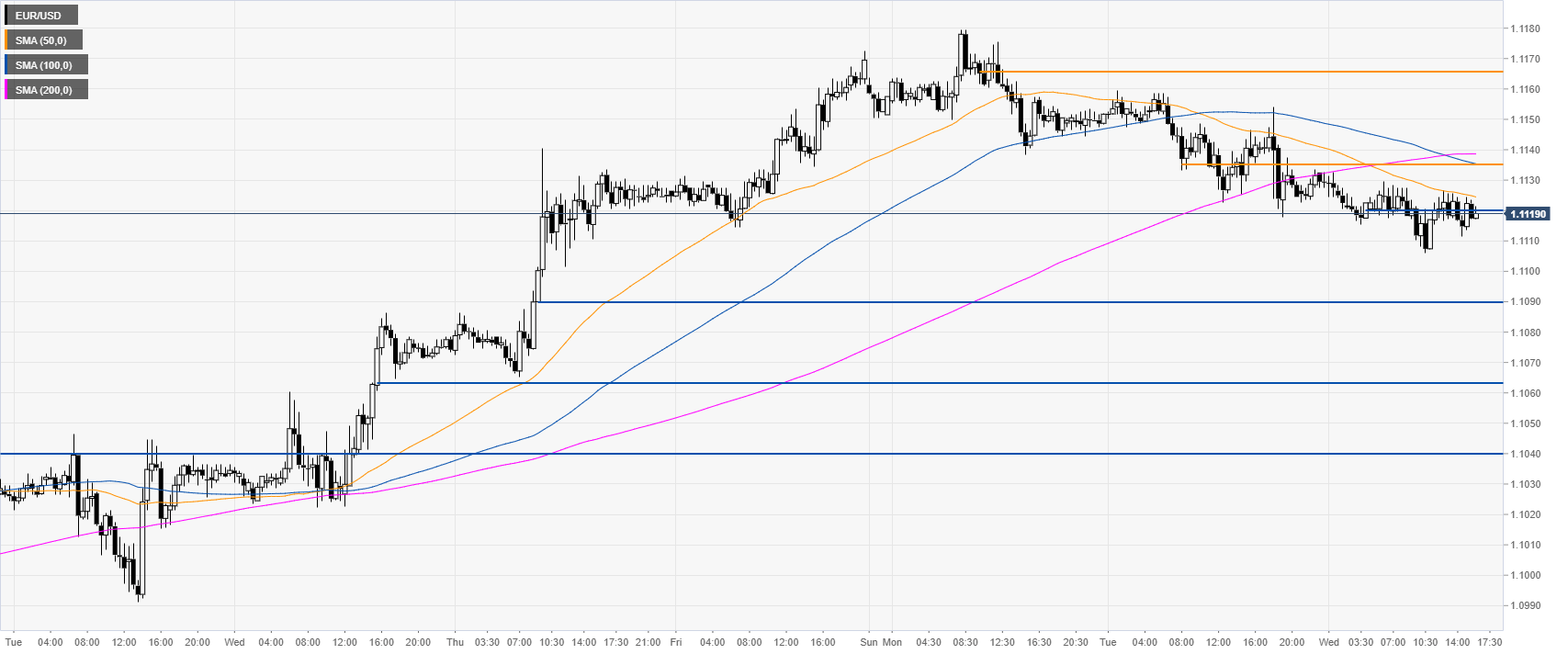

EUR/USD 30-minute chart

The Fiber is trading below its main SMAs on the 30-minute chart, suggesting a bearish bias in the near term. Resistance can be seen near 1.1140 and 1.1160 price levels, according to the Technical Confluences Indicator.

Additional key levels