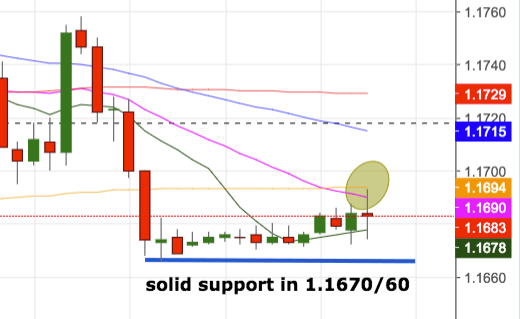

- The pair is prolonging the sideline theme on Thursday, probing the key area around 1.1700 the figure, where sits the 200-hour SMA.

- On the daily chart, the outlook still looks positive while the 21-day SMA underpins, today near 1.1650. Above here, the door remains open for a test of the key area in the mid-1.1800s, where sit June’s peaks and the 38.2% Fibo retracement of the April-May down move.

- In case the selling pressure resumes, hourly (weekly) lows in the 1.1660/70 band should hold well the initial test. Below here lies the 1.1530 area ahead of the ‘double bottom’ in the 1.1500 neighbourhood.

- The daily RSI (14) stays around 44 for the time being, pointing to some extra consolidation in the near term horizon.

Daily high: 1.1670

Daily low: 1.1693

Support Levels

S1: 1.1639

S2: 1.1605

S3: 1.1544

Resistance Levels

R1: 1.1734

R2: 1.1794

R3: 1.1828