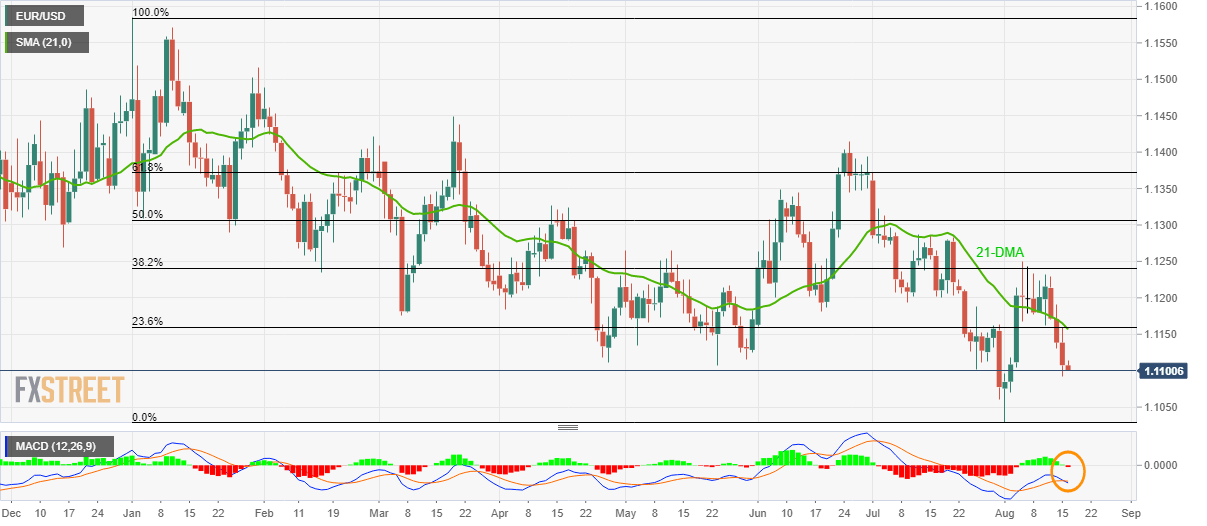

- EUR/USD seesaws near two-week low while being under 1.1157/60 confluence.

- MACD flashes bearish signals.

Following its drop to early-month levels, the EUR/USD pair takes the rounds to 1.1108 during Friday’s Asian session.

12-bar moving average convergence and divergence (MACD) indicate bearish signal for the pair, which in turn highlights 1.1100, 1.1070 and 1.1060 as near-term key supports ahead of pushing bears towards recent low near 1.1027.

In a case prices slip below 1.1027, 1.1000 and 1.0980 could become sellers’ favorites.

Meanwhile, 1.1130 can offer immediate resistance to the pair whereas 23.6% Fibonacci retracement of January-August downpour and 21-day simple moving average (DMA) could restrict further upside around 1.1157/60.

If prices rally beyond 1.1160, June month low at 1.1181 gain market attention.

EUR/USD daily chart

Trend: Bearish