- EUR/USD is down slightly after the release of the US Nonfarm Payrolls (NFP).

- The United States added 144K jobs in July as forecast by analysts while wages came in better-than-expected at 3.2% vs. 3.1% forecast.

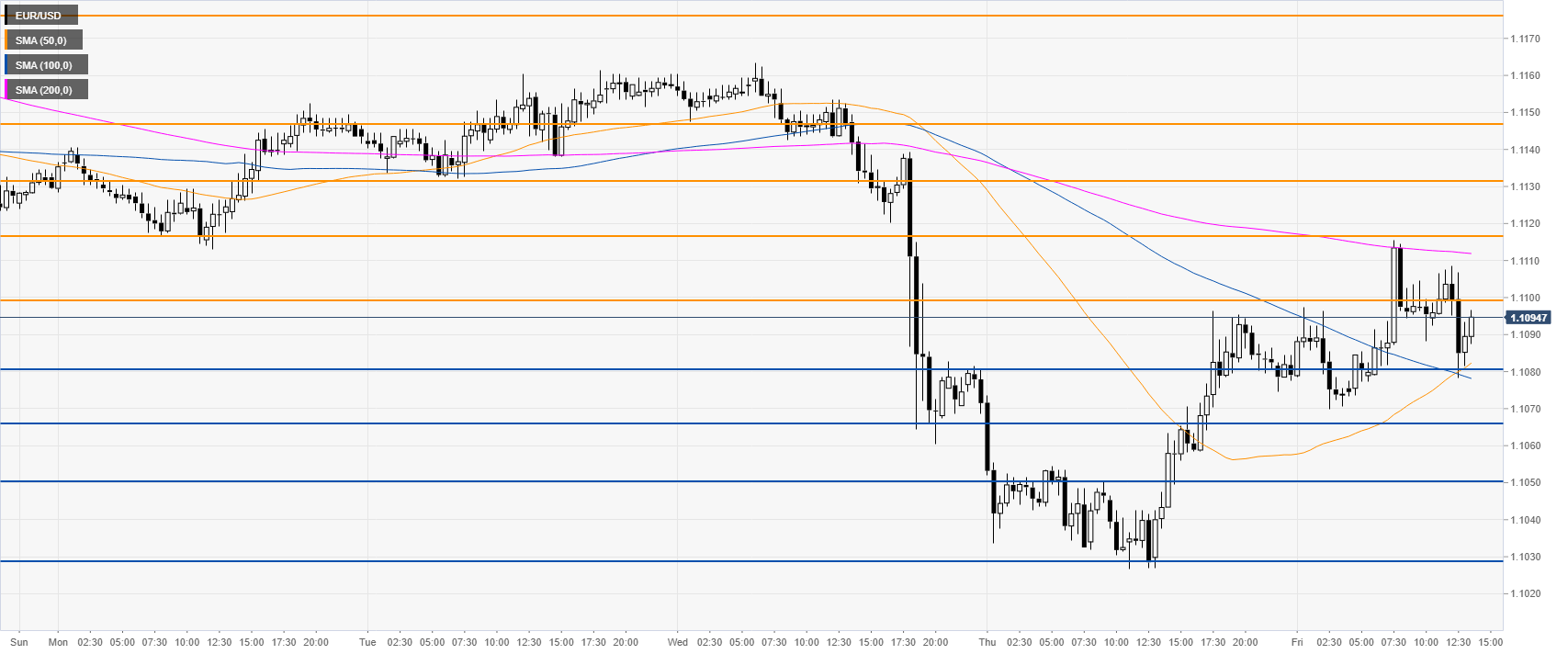

- The level to beat for bulls are seen at the 1.1100, 1.1117, 1.1130 and 1.1147 levels.

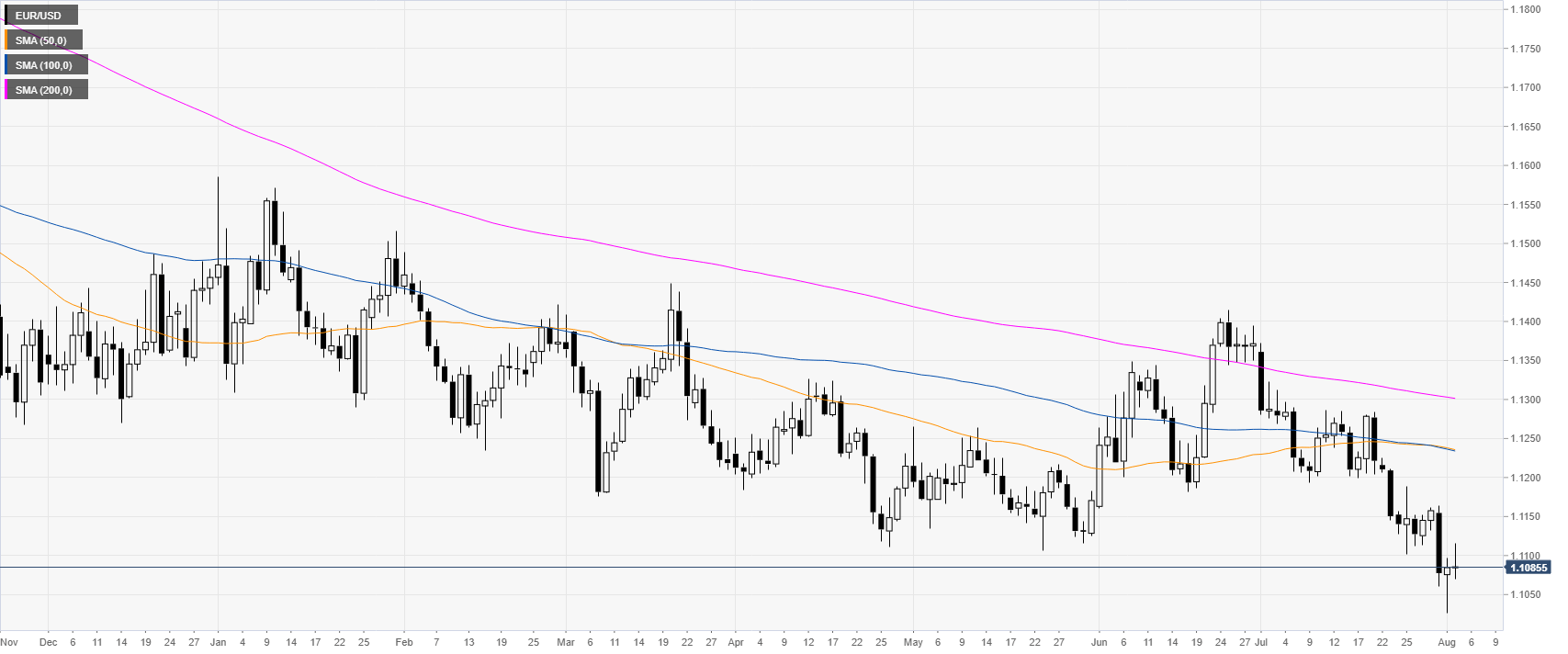

EUR/USD daily chart

EUR/USD is trading in a bear trend below its main daily simple moving averages (DSMAs). The US Nonfarm Payrolls came as forecast at 144K in July while wages came better-than-anticipated at 3.2% vs. 3.1% expected. The reaction on the EUR/USD is slightly bearish with the US Dollar making a small advance.

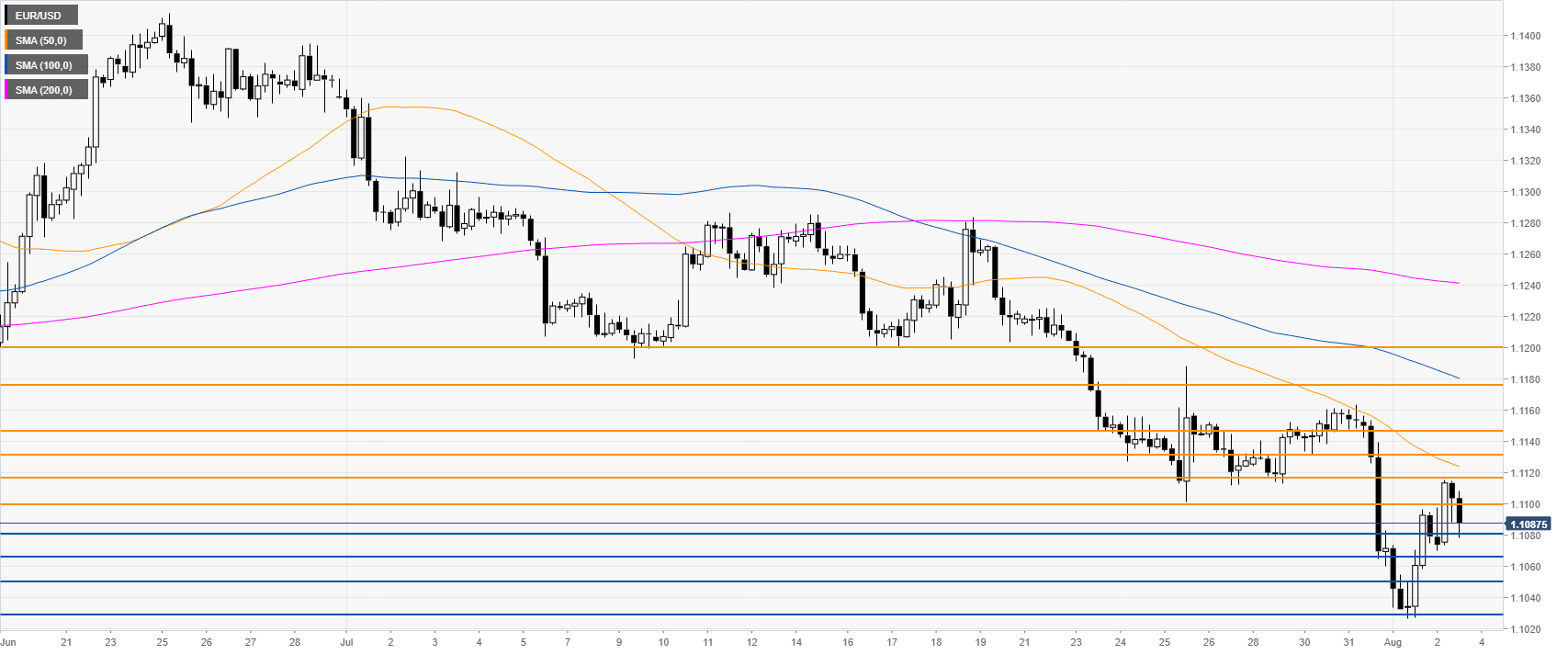

EUR/USD 4-hour chart

EUR/USD is trading below its major simple moving averages (SMAs), suggesting bearish momentum in the medium term. Fiber is declining from the 1.1117 resistance now challenging 1.1080 support. The market will need to break below this level to decline towards 1.1067, 1.1050 and the 1.1030 level, according to the Technical Confluences Indicator.

EUR/USD 30-minute chart

The market is trading above the 50 and 100 SMAs, suggesting a correction up in the near term. Buyers would need to reclaim 1.1100 resistance to reach 1.1117, 1.1130, 1.1147 and potentially 1.1176 if the bulls gather enough steam.

Additional key levels