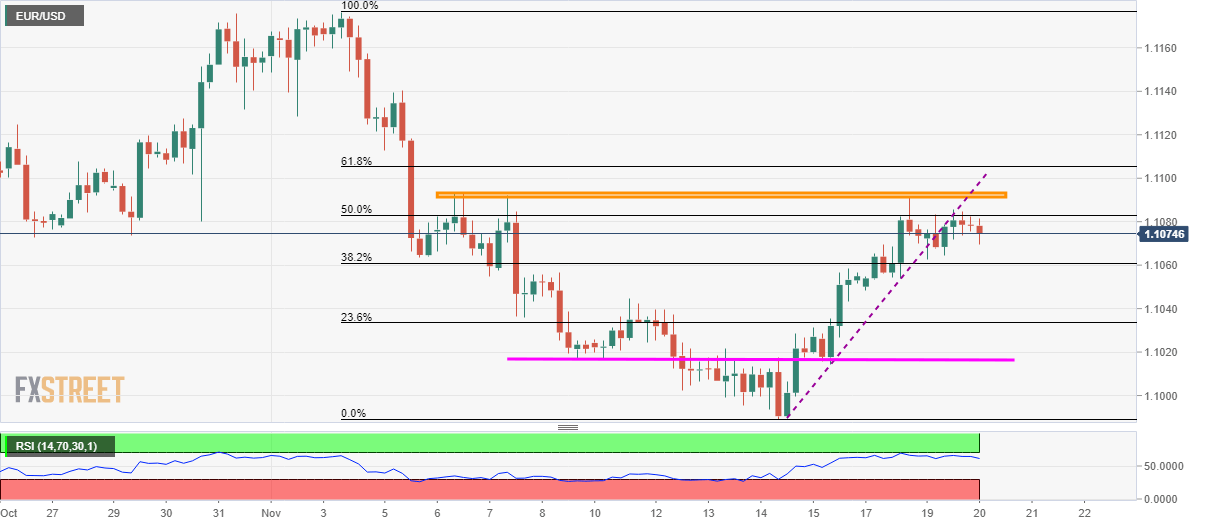

- EUR/USD extends a breakdown of a weeklong rising trend line.

- November 11 high, 1.1016/15 could appear next on the sellers’ radar.

- 61.8% Fibonacci retracement adds to the resistance.

With its failure to cross a fortnight-long horizontal resistance area, EUR/USD declines to 1.1075 while heading into the European session on Wednesday.

The quote now aims to revisit November 11 high around 1.1045 ahead of revisiting the 1.1016/15 multiple support zone.

If prices refrain from bouncing off 1.1015, the monthly low near 1.0990 will be on their radars prior to October bottom of 1.0880.

On the upside break of the 1.1090/95 resistance area, buyers need to conquer the weeklong support-turned-resistance around 1.1100 while 61.8% Fibonacci retracement level of the current month downside, at 1.1105 could question the bulls afterward.

In a case of pair’s successful rise beyond 1.1105, 1.1140 and monthly top close to 1.1180 will come back on the chart

EUR/USD 4-hour chart

Trend: Bearish