- The pair has managed to regain 1.1400 the figure and beyond, although political concerns in Germany and Italy are poised to keep the European currency under pressure.

- The initial target on the downside is now last Friday’s low at 1.1331, ahead of the critical 200-week SMA, today at 1.1316. This is considered the last defense for a test of YTD low at 1.1299 seen in mid-August.

- On the upside, interim hurdle emerges at the 10-day SMA at 1.1456 ahead of the critical 1.1500 neighbourhood, where coincide the 21-day SMA and May/June lows.

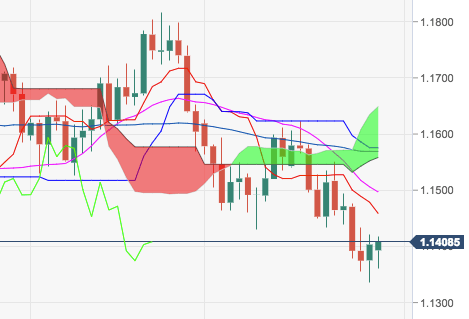

EUR/USD daily chart

EUR/USD

Overview:

Last Price: 1.1415

Daily change: -1.2e+2 pips

Daily change: -1.01%

Daily Open: 1.1531

Trends:

Daily SMA20: 1.1571

Daily SMA50: 1.1584

Daily SMA100: 1.1623

Daily SMA200: 1.1909

Levels:

Daily High: 1.154

Daily Low: 1.1531

Weekly High: 1.1551

Weekly Low: 1.1336

Monthly High: 1.1816

Monthly Low: 1.1526

Daily Fibonacci 38.2%: 1.1496

Daily Fibonacci 61.8%: 1.1472

Daily Pivot Point S1: 1.1453

Daily Pivot Point S2: 1.1392

Daily Pivot Point S3: 1.1351

Daily Pivot Point R1: 1.1555

Daily Pivot Point R2: 1.1596

Daily Pivot Point R3: 1.1657