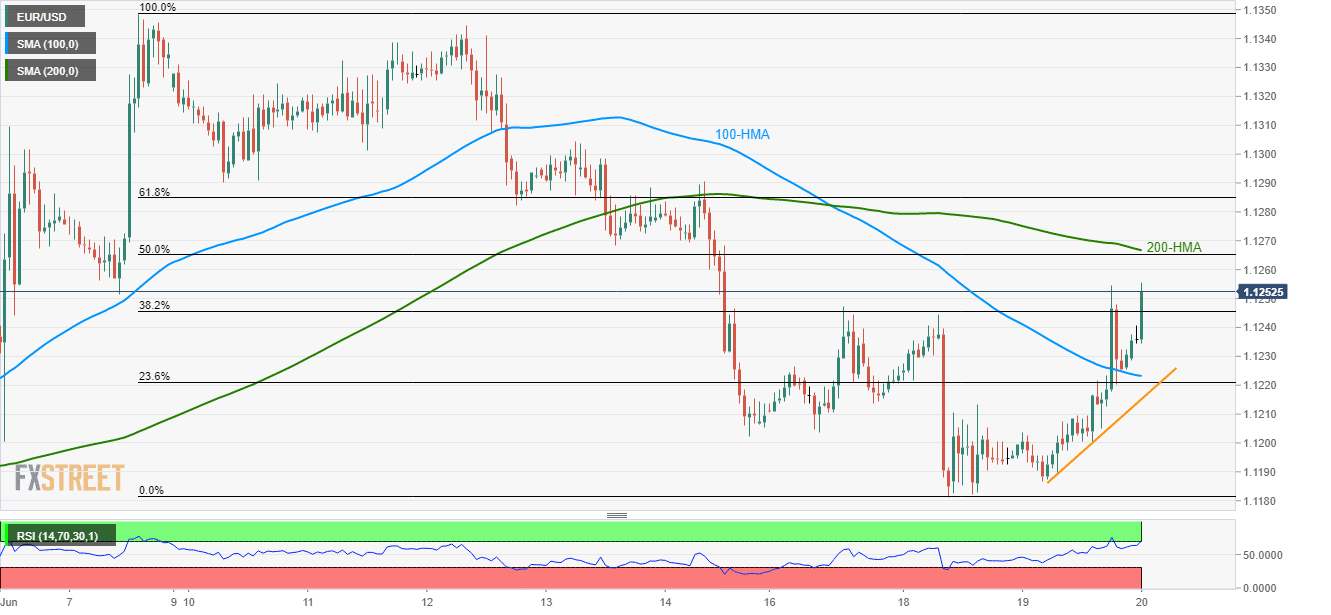

- Sustained trading beyond 100-HMA helps the buyers to target 200-HMA.

- Overbought RSI challenges the upside momentum.

Having failed to visit 200-HMA during the post-Fed rally, the EUR/USD pair again rises towards the MA as it trades near 1.1255 during early Thursday.

However, overbought levels of 14-bar relative strength index (RSI) is likely again challenging the quote, which if ignored could flash 1.1267 figure comprising 200-hour moving average (HMA) on the chart.

Should there be additional rise past-1.1267, 61.8% Fibonacci retracement of recent 13-days’ decline at 1.1285 and 1.1300 round-figure may mark their presence.

Alternatively, 1.1245 and 100-HMA of 1.1223 can offer immediate support, a break of which can drag prices close to 1.1200 level.

Assuming bears’ dominance past-1.1200, latest low around 1.1180 and June 03 bottom near 1.1160 might flash on their list.

EUR/USD hourly chart

Trend: Pullback expected