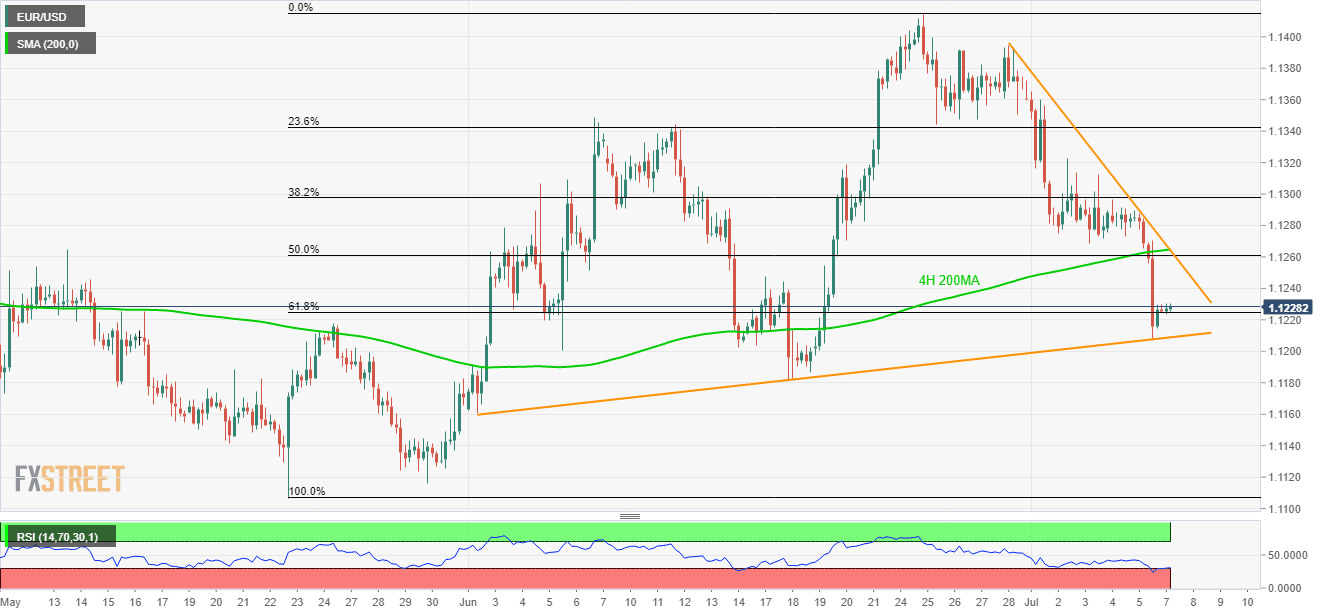

- A month-old ascending trend-line, oversold RSI conditions can propel the EUR/USD moves towards the north.

- 4H 200MA, 10-day long resistance-line seems a tough upside barrier.

Despite showing little momentum beyond 61.8% Fibonacci retracement, oversold RSI conditions and sustained trading above short-term support-line portrays the EUR/USD pair’s strength as it takes rounds to 1.1230 during early Asian morning on Monday.

June 17 high near 1.1247 can act as immediate resistance for the pair ahead of fuelling it to 1.1264/65 confluence area including 200-bar moving average (4H 200MA) and 10-day long descending trend-line.

In a case where prices rally past-1.1265, 1.1300 and 23.6% Fibonacci retracement of late-May to June increase near 1.1345 can lure buyers.

It should be noted that oversold conditions of 14-bar relative strength index (RSI) favor the pair’s fresh buying.

Meanwhile, a downside break of 1.1209 support-line can trigger the quote’s fresh downpour to June 18 low surrounding 1.1180.

However, multiple supports around 1.1140, followed by May-end low near 1.1104, could question bears after.

EUR/USD 4-hour chart

Trend: Pullback expected