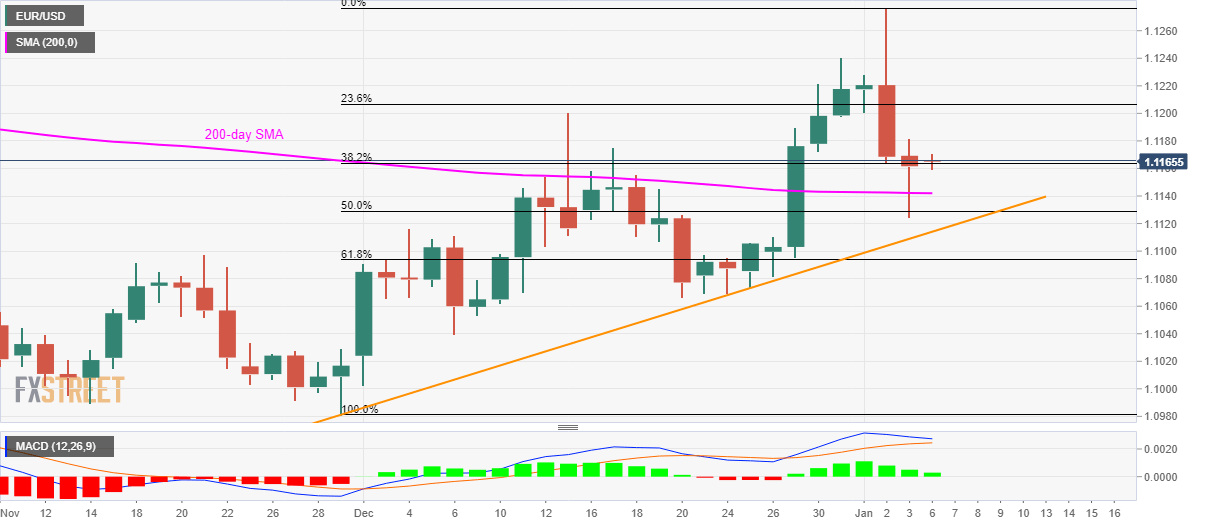

- EUR/USD bounces off 38.2% Fibonacci retracement.

- A five-week-old rising trend line adds to support below 200-day SMA.

- December 13 top, year-start low hold the key to further upside.

EUR/USD rises to 1.1170 during the Asian session on Monday. In doing so, the pair reverses from 38.2% Fibonacci retracement of its November 29 to January 02 upside while also refraining to extend losses piled since Thursday.

Considering the pair’s sustained trading above 200-day SMA and bullish MACD, coupled with the latest bounce off 38.2% Fibonacci retracement, prices may extend the recovery towards 1.1200 mark comprising high of December 13 and lows marked on January 01.

Should there be an extension of the pullback beyond 1.1200, the 2019 closing, around 1.1240, can question buyers targeting 1.1280.

Meanwhile, pair’s declines below 200-day SMA level of 1.1142 can take rest on an ascending trend line stretched since late-November, at 1.1115.

In a case where the Bears dominate below 1.1115, also conquer 1.1100 round figure, multiple bottoms around 1.1070 can lure them.

EUR/USD daily chart

Trend: Pullback expected