- The pair advanced almost a cent to the boundaries of 1.1400 the figure earlier today after testing fresh 13-month lows in the 1.1300 neighbourhood on Wednesday.

- If the 1.1300 area is cleared on a sustainable fashion, expect the 1.1188 level to come to the fore. This represents the 61.8% Fibo retracement of the 2017-2018 rally.

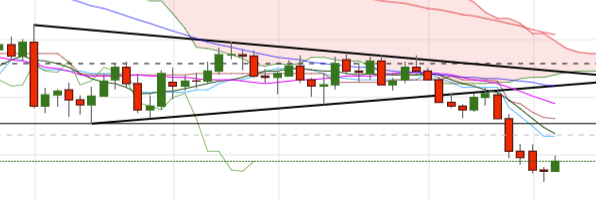

- In the meantime, the recent oversold condition of the pair allows for a bullish attempt, with interim resistance at the 10-day SMA at 1.1473 and seconded by the more relevant 1.1508/10 band, former ‘double bottom’ and May/June lows. Further up, the 21-day SMA should emerge as the next level of resistance ahead of last week’s tops in the 1.1630 region and the base of the daily cloud.

- Furthermore, the near/medium term negative outlook remains unaltered as long as the 1.1745/50 band caps.

Daily high: 1.1399

Daily low: 1.1335

Support Levels

S1: 1.1312

S2: 1.1279

S3: 1.1258

Resistance Levels

R1: 1.1367

R2: 1.1388

R3: 1.1421