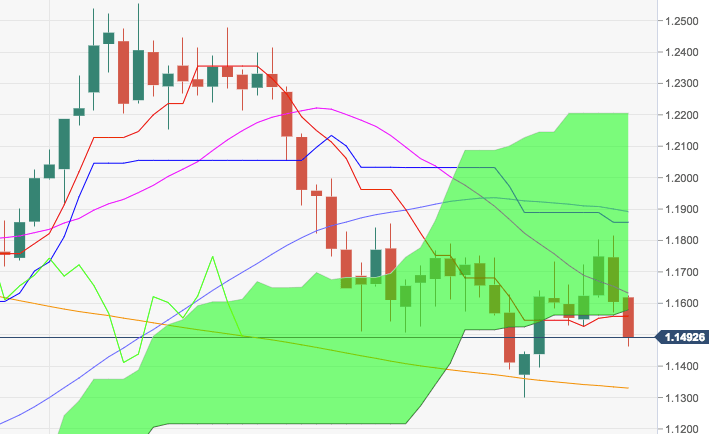

- The pair has resumed the downside today, returning to the 1.1500 neighbourhood as cautiousness prevails in the global markets in light of the US Non-farm Payrolls.

- EUR/USD stays supported near term by the 1.1460/50 band, where converge this week’s lows and the 50% Fibo retracement of the 2017-2018 rally at 1.1449.

- A move further south should put the 200-week SMA, today at 1.1331, back on the horizon. This is regarded as the last defence of the 2018 low at 1.1299 (August 15).

- On the weekly chart, spot has broken below the base of the cloud, supporting the idea that further pullbacks are in the pipeline.

EUR/USD

Overview:

Last Price: 1.1493

Daily change: -21 pips

Daily change: -0.182%

Daily Open: 1.1514

Trends:

Daily SMA20: 1.1643

Daily SMA50: 1.1599

Daily SMA100: 1.1641

Daily SMA200: 1.1934

Levels:

Daily High: 1.1543

Daily Low: 1.1464

Weekly High: 1.1816

Weekly Low: 1.157

Monthly High: 1.1816

Monthly Low: 1.1526

Daily Fibonacci 38.2%: 1.1513

Daily Fibonacci 61.8%: 1.1494

Daily Pivot Point S1: 1.1471

Daily Pivot Point S2: 1.1428

Daily Pivot Point S3: 1.1391

Daily Pivot Point R1: 1.1551

Daily Pivot Point R2: 1.1587

Daily Pivot Point R3: 1.163