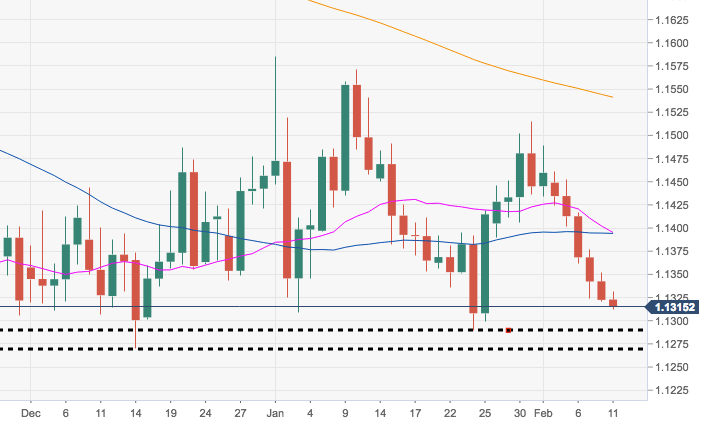

- EUR/USD remains on the defensive, intensifying the bearish sentiment following the recent breakdown of the critical 200-week SMA in the 1.1330 region.

- Further losses should meet strong support in the 1.1289/69 band in the near term, where coincide YTD lows and December 2018 lows. This area is expected to hold the downside.

- On the other hand, a surpass of the key 100-day SMA at 1.1424 should mitigate the downside pressure.

EUR/USD daily chart

EUR/USD

Overview:

Today Last Price: 1.1318

Today Daily change: 20 pips

Today Daily change %: -0.04%

Today Daily Open: 1.1322

Trends:

Daily SMA20: 1.1399

Daily SMA50: 1.14

Daily SMA100: 1.1425

Daily SMA200: 1.1544

Levels:

Previous Daily High: 1.1353

Previous Daily Low: 1.132

Previous Weekly High: 1.1462

Previous Weekly Low: 1.132

Previous Monthly High: 1.1586

Previous Monthly Low: 1.1289

Daily Fibonacci 38.2%: 1.1333

Daily Fibonacci 61.8%: 1.134

Daily Pivot Point S1: 1.1311

Daily Pivot Point S2: 1.13

Daily Pivot Point S3: 1.1279

Daily Pivot Point R1: 1.1343

Daily Pivot Point R2: 1.1364

Daily Pivot Point R3: 1.1375