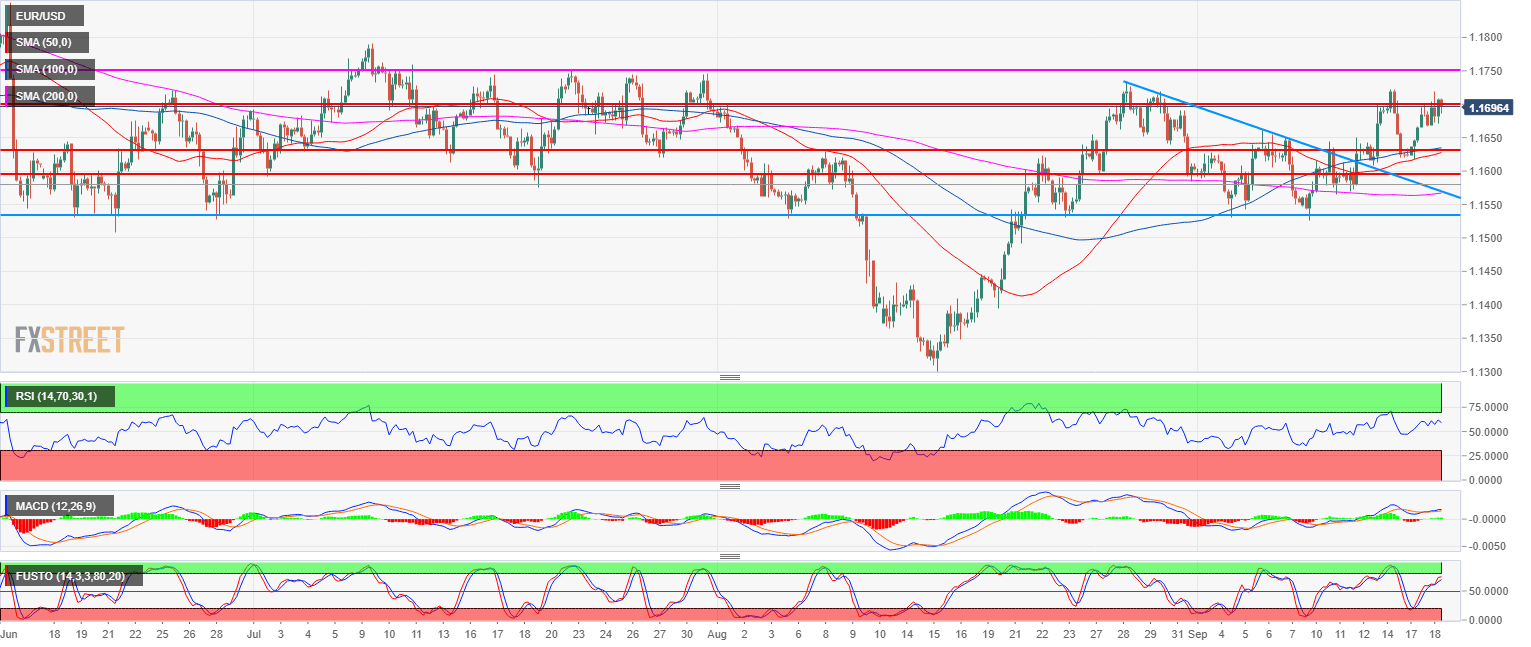

- EUR/USD main bear trend is on hold for the sixth consecutive week as the bulls are trying to create a reversal up.

- EUR/USD is currently consolidating the recent advance from the triangle compression pattern (blue lines) just below the 1.1700 level. EUR/USD is trading above its 50, 100 and 200-period simple moving average on the 4-hour chart suggesting a bullish bias. Bulls objective is to break above 1.1750 which was a strong resistance level in July, therefore it is to be expected that bulls take time to gather enough momentum in order to breakout above 1.1750 level.

- On the flip side, if the bears take over the market and drive it below 1.1530 it would likely signify that the bullish bias has switched to bearish.

Spot rate: 1.1700

Relative change: 0.16%

High: 1.1718

Low: 1.1666

Main trend: Bearish

Short-term trend: Bullish above 1.1530

Resistance 1: 1.1722 last week high

Resistance 2: 1.1750 key resistance (July)

Resistance 3: 1.1800 figure

Resistance 4: 1.1853 June 14 high

Support 1: 1.1654 August 27 high

Support 2: 1.1630 August 8 high key level

Support 3: 1.1600 figure

Support 4: 1.1572 July 19 low

Support 5: 1.1542 supply/demand level

Support 6: 1.1530 August 23 swing low

Support 7: 1.1508 June 8 low