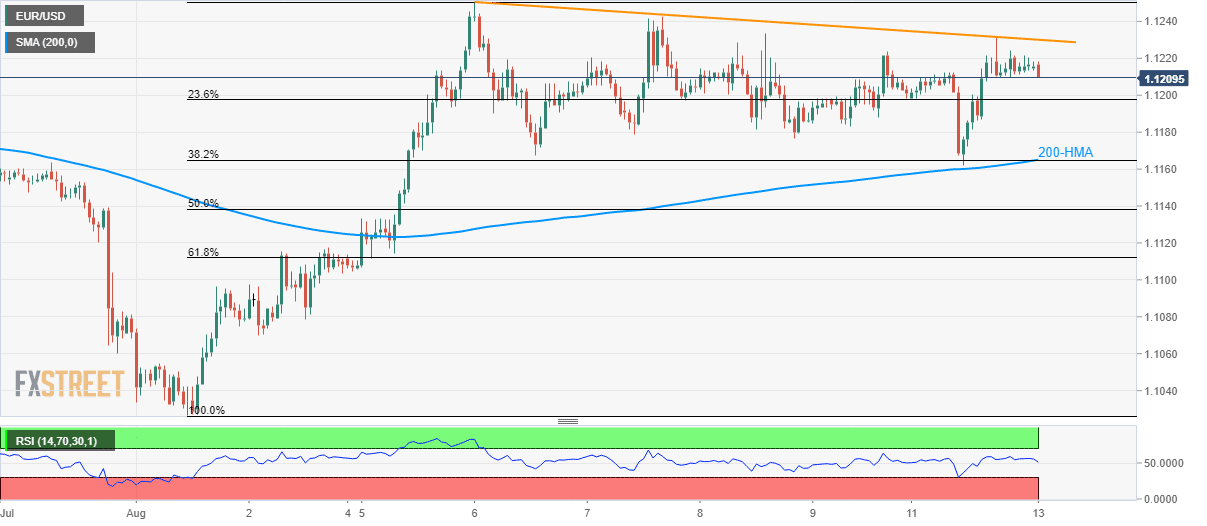

- EUR/USD buyers struggle to justify bounce off 200-HMA as prices fail to cross immediate resistance-line.

- 1.1165 becomes near-term key support.

- RSI also portrays a lack of momentum.

Even after holding successfully beyond 200-hour moving average (HMA), EUR/USD remains below one-week-old resistance-line as it trades near 1.1215 during Tuesday morning in Asia.

While 1.1230, comprising adjacent descending trend-line, becomes nearby strong resistance, 23.6% Fibonacci retracement of its current month advances, at 1.1198, seems close support to watch during the pullback.

Though, a confluence of 200-HMA and 38.2% Fibonacci retracement near 1.1165 becomes the strong support, a break of which highlights 1.1130 and 61.8% Fibonacci retracement level of 1.1112 as next rests.

Alternatively, pair’s break of 1.1230 enables it to challenge monthly top around 1.1240 with a late-July high near 1.1285 being the next in the sight.

It should also be noted that the 14-bar relative strength index (RSI) remains normal while portraying the momentum.

EUR/USD hourly chart

Trend: Sideways