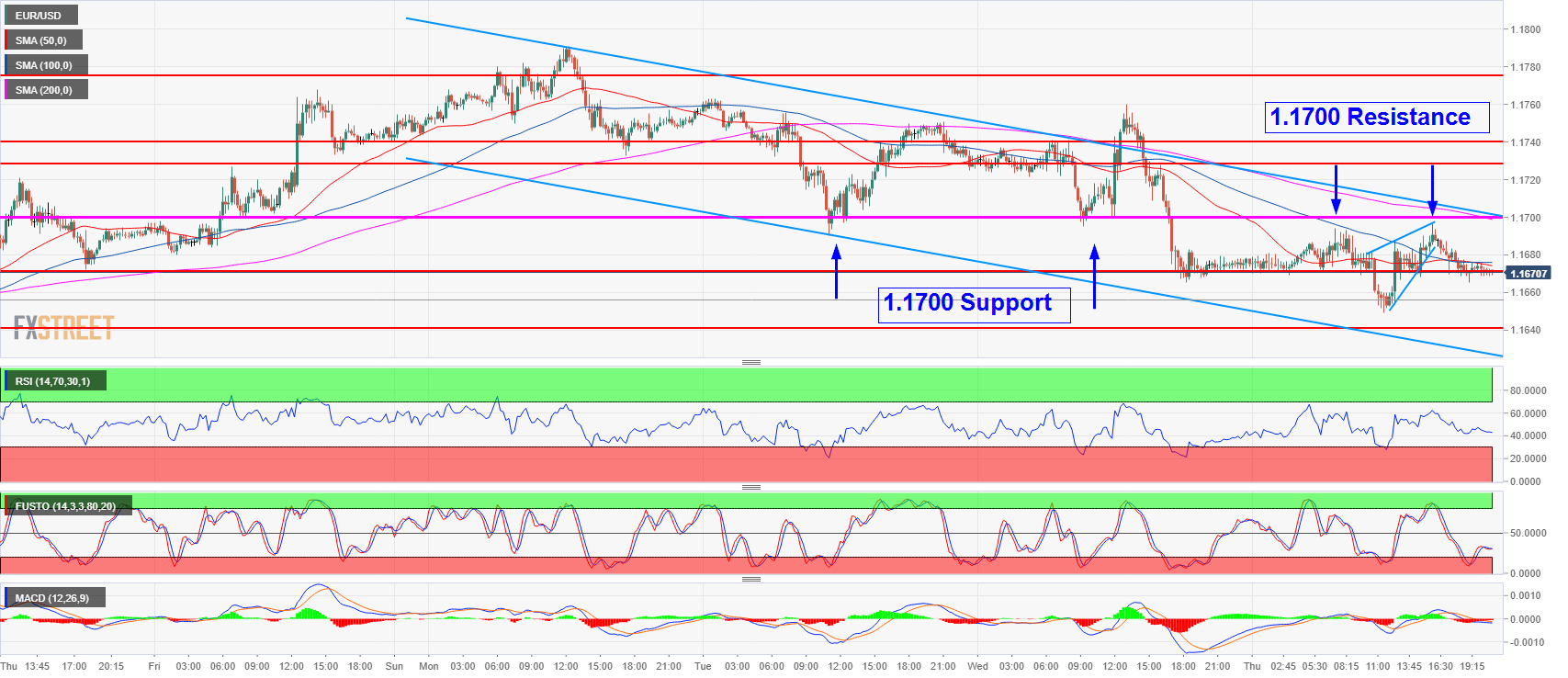

- EUR/USD ended this Thursday virtually unchanged as the daily bar formed a doji, signaling indecision on both sides. After a doji, the market usually follows the path of least resistance. Since the week has seen lower highs and lower lows, odds favor a bearish continuation.

- Earlier in the American session, the weak run up (blue wedge) was not strong enough to break the 1.1700 figure. This was the second attempt on Thursday to break above the figure. As a reminder 1.1700 was support earlier in the week and it has now become resistance.

- What would negate the bearish scenario is a strong breakout above the 1.1700 level and a sustained follow-through above 1.1740, the open of the week.

EUR/USD 15-minute chart

Spot rate: 1.1671

Relative change: -0.03%

High: 1.1696

Low: 1.1649

Trend: Bearish

Resistance 1: 1.1700 figure

Resistance 2: 1.1720-1.1730-1.1740 area, June 26 high, 23.6% Fibonacci retracement from mid-April-May bear move and weekly open.

Resistance 3: 1.1775 supply level

Resistance 4: 1.1800 figure

Resistance 5: 1.1851-1.1854 area, June high and 38.2% Fibonacci retracement from mid-April-May bear move

Support 1: 1.1672 June 27 high

Support 2: 1.1640 supply/demand level

Support 3: 1.1600 figure

Support 4: 1.1560 June 14 low

Support 5: 1.1508 current 2018 low

EUR/USD daily chart

A rather flat daily 21-period simple moving average is currently containing the price.