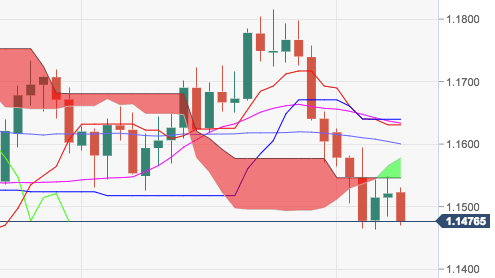

- EUR/USD has started the week on a negative fashion after two consecutive daily advances.

- The pair is now trading closer to recent lows in the 1.1460 region, and a break below this level should open the door for a visit to 1.1449 (Fibo retracement of the 2017-2018 up move) and the 200-week SMA in the 1.1330 region.

- Further south lies the 2018 low at 1.1299 (August 15), which is expected to come to the fore if the selling bias accelerates.

- Also fuelling the idea of extra downside, spot has broken below the base of the cloud both in the daily and weekly charts.

EUR/USD

Overview:

Last Price: 1.1478

Daily change: -43 pips

Daily change: -0.373%

Daily Open: 1.1521

Trends:

Daily SMA20: 1.1641

Daily SMA50: 1.1597

Daily SMA100: 1.1638

Daily SMA200: 1.1933

Levels:

Daily High: 1.155

Daily Low: 1.1484

Weekly High: 1.1625

Weekly Low: 1.1464

Monthly High: 1.1816

Monthly Low: 1.1464

Daily Fibonacci 38.2%: 1.1525

Daily Fibonacci 61.8%: 1.1509

Daily Pivot Point S1: 1.1487

Daily Pivot Point S2: 1.1452

Daily Pivot Point S3: 1.1421

Daily Pivot Point R1: 1.1553

Daily Pivot Point R2: 1.1584

Daily Pivot Point R3: 1.1619