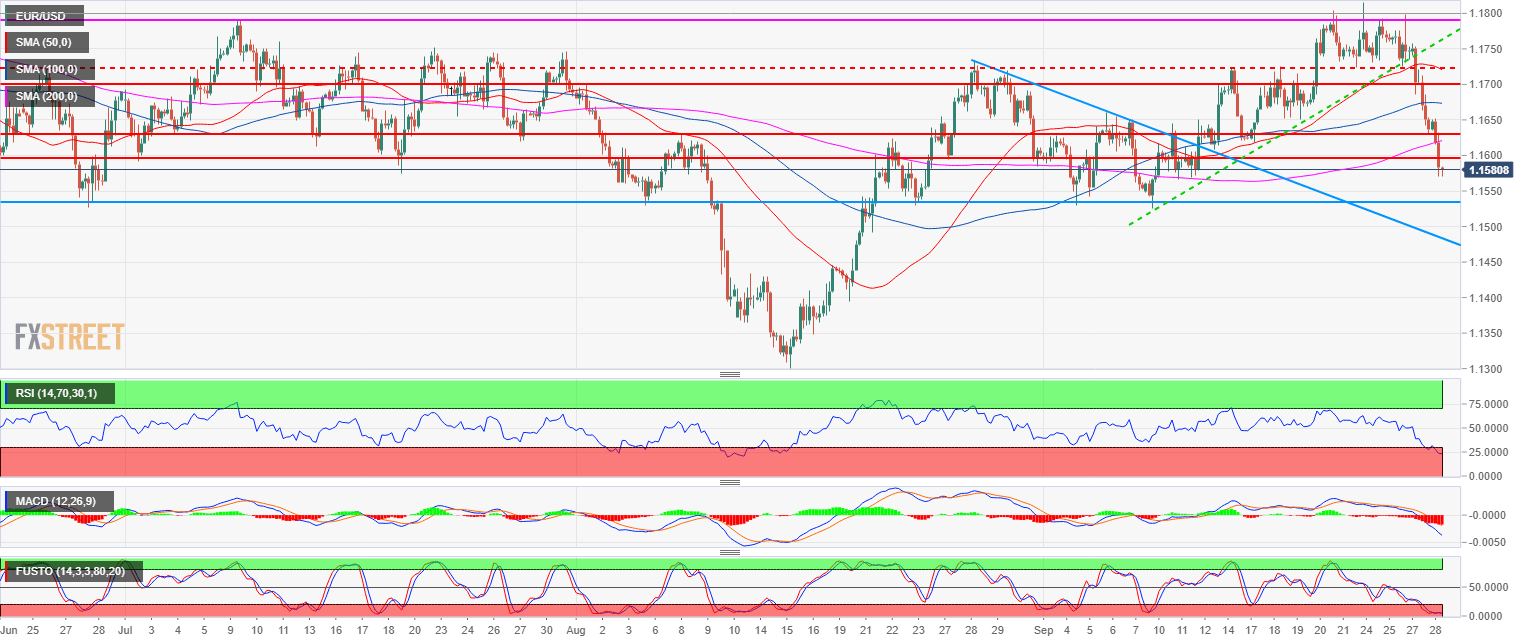

- EUR/USD bears want to re-establish the bear trend of the last months as the EUR/USD is falling through many support levels.

- EUR/USD is trading below its 50, 100 and 200-period simple moving average as the MACD indicator is in negative territories, suggesting short-term bearish momentum.

- A break below 1.1530 would be bearish for EUR/USD. Above it, EUR/USD bulls will try to support the market. The RSI and Stochastics are deeply in oversold condition suggesting that bulls might start to slowly show up above 1.1530.

Spot rate: 1.1582

Relative change: -0.50%

High: 1.1758

Low: 1.1670

Main trend: Bullish

Resistance 1: 1.1600 figure

Resistance 2: 1.1630 August 8 high key level

Resistance 3: 1.1654 August 27 high

Resistance 4: 1.1723 September 24 low

Resistance 5: 1.1750 key level (July)

Resistance 6: 1.1800 figure

Resistance 7: 1.1853 June 14 high

Resistance 5: 1.1900 figure

Support 1: 1.1572 July 19 low

Support 2: 1.1542 supply/demand level

Support 3: 1.1530 August 23 swing low

Support 4: 1.1508 June 8 low