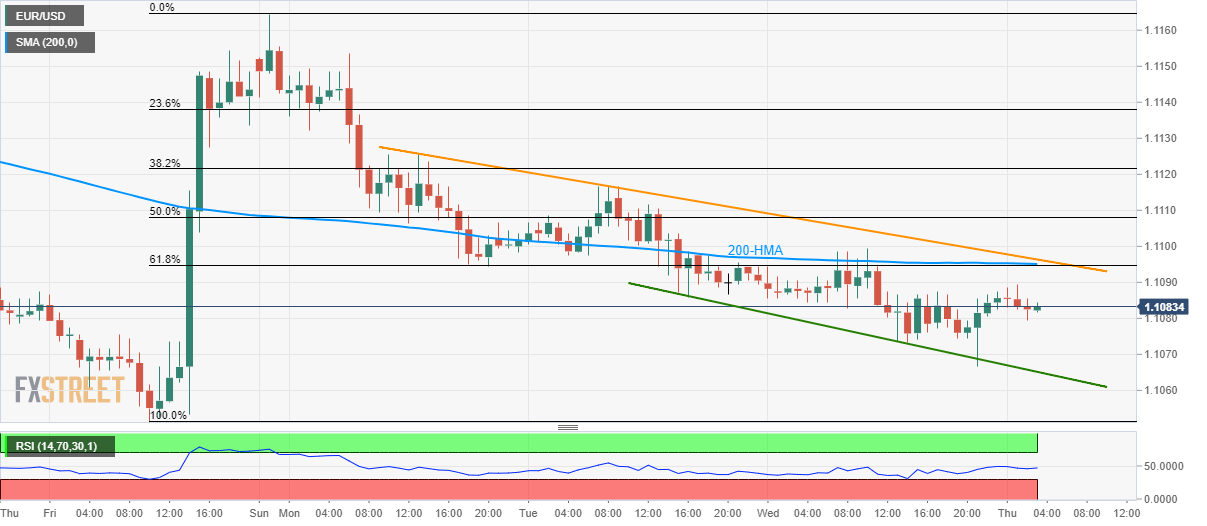

- 200-HMA, 61.8% Fibonacci retracement and a falling trend-line since late-Monday limit near-term upside of the EUR/USD pair.

- Descending support-line from Tuesday can offer immediate support.

Despite its recent bounce off two-day-old support-line, EUR/USD trades well below key resistance-confluence as it takes the rounds to 1.1085 during early Thursday in Asia.

Given the pair’s repeated failures to cross the key upside barrier, chances of its another dip towards immediate support-line at 1.1065 seem brighter.

In a case prices keep declining below 1.1065, recent low near 1.1050 and the monthly bottom surrounding 1.1027 holds the gate for the EUR/USD pair’s south-run to 1.1000 round-figure.

Meanwhile, 200-hour simple moving average (HMA), 61.8% Fibonacci retracement of recovery since last-Friday and a downward sloping trend-line from late-Monday together constitute 1.1095-1.1100 as the key resistance-area.

Should buyers manage to conquer 1.1100, a quick run-up to 1.1135 and weekly top close to 1.1165 will become highly likely.

EUR/USD hourly chart

Trend: bearish