- EUR/USD flirts with daily highs in the 1.0860/70 band.

- Dollar loses the grip and recedes from earlier tops.

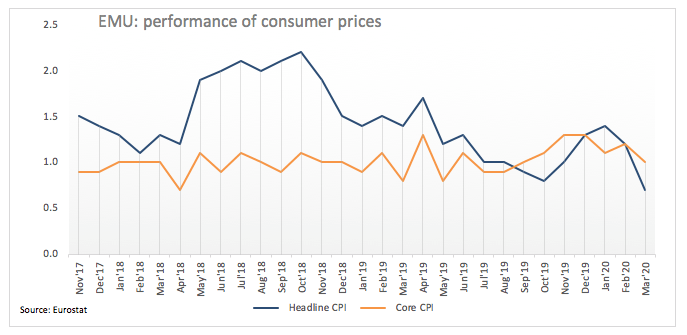

- Final EMU CPI rose 0.5% MoM and 0.7% YoY in March.

The bearish note around the single currency looks somewhat mitigated on Friday, with EUR/USD now managing to regain traction and test the upper end of the range around 1.0860.

EUR/USD picks up pace after daily lows

EUR/USD is posting gains for the first time after two consecutive daily pullbacks. The initial downside in the spot has been intensified by the buying pressure in the greenback, in turn sustained by increasing inflows into the safe haven universe.

In fact, unabated jitters around the coronavirus and the impact on the global economy have signalled once again the investors’ preference for the dollar in a context dominated by the risk aversion.

In the calendar, final March inflation figures in the broader Euroland saw headline consumer prices rising at a monthly 0.5% and 0.7% from a year earlier. Prices stripping food and energy costs rose 1.1% MoM and 1.0% over the last twelve months. Across the pond, the only release will be the Leading Index, also for the month of March.

What to look for around EUR

What to look for around EUR

The euro is extending the selling mood so far this week, always with the COVID-19 and the economic depression that will surely emerge in the next months in the limelight. On the more macro view, the single currency is expected to come under pressure in the next periods in light of the forecasted contraction in the economy of the region in the first half of the year, relegating hopes of a strong recovery to Q3 and/or Q4.

EUR/USD levels to watch

At the moment, the pair is gaining 0.25% at 1.0865 and a breakout of 1.0990 (weekly/monthly high Apr.15) would target 1.1052 (200-day SMA) en route to 1.1147 (weekly high Mar.27). On the downside, the next support aligns at 1.0814 (78.6% Fibo of the 2017-2018 rally) followed by 1.0768 (monthly low Apr.6) and finally 1.0635 (2020 low Mar.23).

What to look for around EUR

What to look for around EUR