- EUR/USD’s upside faltered just below the key 1.20 mark.

- Dollar weakness keeps bolstering the move up in the pair.

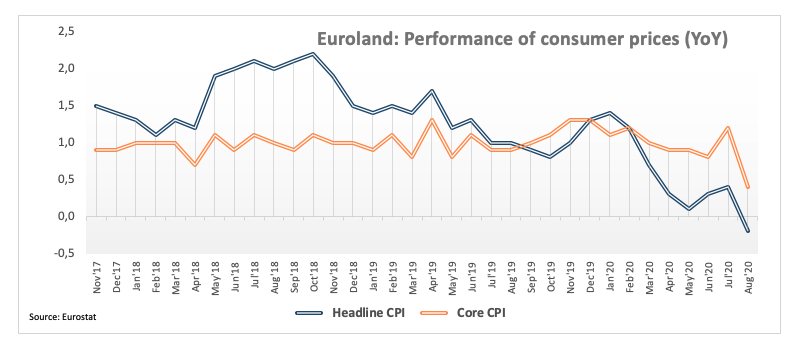

- EMU’s flash CPI came in at -0.4% MoM and 0.2% YoY.

The buying interest around the single currency remains well and sound for yet another session and is now lifting EUR/USD to the boundaries of the psychological 1.20 mark, clinching at the same time fresh 2020 highs.

EUR/USD stronger on USD-selling

EUR/USD advanced to the doorsteps of the 1.20 yardstick earlier in the session, easing some ground soon afterwards albeit keeping the bullish bias intact for the time being.

The persistent selling pressure keeps hurting the dollar and dragged the US Dollar Index to fresh lows in the sub-92.00 area, levels last visited in May 2018. It is worth recalling that the negative sentiment around the buck picked up extra pace in response to the dovish perception by market participants of Powell’s speech and the subsequent announcement that the Fed will now pursue an Average Inflation Targeting (AIT).

In the docket, final manufacturing PMIs in the euro area came in pretty in line with the preliminary gauges, while the German Unemployment Change went down by 9K and the jobless rate stayed unchanged at 6.4% in August. In the broader Euroland, advanced inflation figures expect the headline consumer prices to contract 0.2% on a year to August and to rise 0.4% when comes to prices stripping food and energy costs.

Later in the NA session, the US ISM Manufacturing will take centre stage seconded by the final print of Markit’s manufacturing PMI.

What to look for around EUR

EUR/USD broke above the multi-day rangebound theme last week and managed to test the vicinity of the key 1.20 mark earlier on Tuesday. In the meantime, the sell-off in the dollar gives extra legs to the rally that started in July, all accompanied by the improved sentiment in the risk-associated universe, auspicious results from domestic fundamentals – which have been in turn supporting further the view of a strong economic recovery following the coronavirus crisis – as well as US-China positive headlines. Also lending wings to the momentum around the euro appear the deal on the European Recovery Fund – which helped putting political fears within the bloc to rest (for now) – and the solid position of the current account in the region. In addition, the speculative community has supported the bullish stance on the euro for yet another week (as per the latest CFTC positioning report).

EUR/USD levels to watch

At the moment, the pair is up 0.30% at 1.1971 and a move above 1.1997 (2020 high Sep.1) would target 1.2000 (psychological mark) en route to 1.2032 (23.6% Fibo of the 2017-2018 rally). On the other hand, the next support is located at 1.1772 (weekly low Aug.26) seconded by 1.1754 (weekly low Aug.21) and finally 1.1695 (monthly low Aug.3).