- EUR/USD has been benefiting from Fed Powell’s dovish comments.

- Virus and fiscal concerns in Europe and profit-taking on Wall Street may trigger a setback.

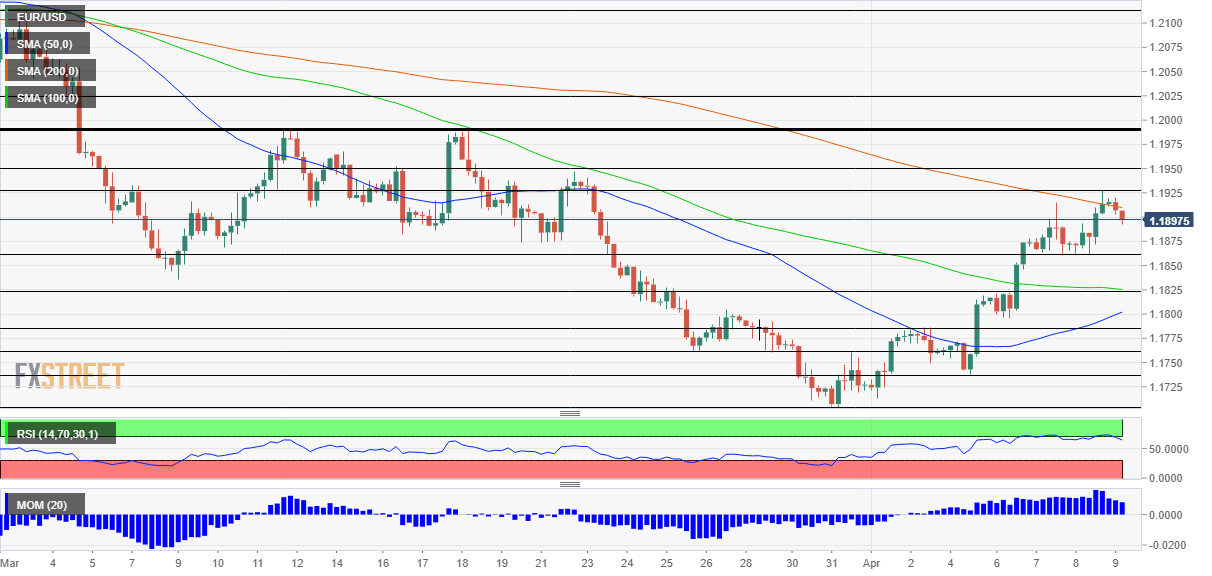

- Friday’s four-hour chart is showing that the currency pair is still near overbought conditions.

“We are not really looking at forecasts for this purpose, we are looking at actual progress” – Jerome Powell, Chair of the Federal Reserve, has reiterated the bank’s commitment to act only when the economy fully recovers. For the dollar, that has meant additional pressure, allowing EUR/USD to hold onto its high ground.

Can this uptrend continue? While the world’s most powerful central bank is focused on outcomes, not outlooks, and continues printing greenback, Powell’s messages were not new. On Friday, investors already have a somewhat different view – the recovery in US Treasury yields have edged higher, underpinning the greenback and pushing EUR/USD under 1.19.

Another factor somewhat pressuring the greenback is the disappointing increase of American jobless claims to 744,000, holding above 700,000 for the second consecutive week.

However, EUR/USD bears may have more to chew on in Europe. Isabel Schnabel of the European Central Bank warned that delaying EU fiscal aid would be a “catastrophe.” She shed light on issues with distributing the already agreed New Generation funds.

America’s fiscal support has been far more robust and has been flowing rapidly in the past year. President Joe Biden is currently focused on gun issues, but his team continues pushing for the next splurge – the $2.25 trillion infrastructure plan.

The old continent’s more significant issues come from covid. Cases remain elevated in Germany, France, and Italy, with Spain joining in with fresh post-Easter increases. Moreover, several EU countries have banned the usage of AstraZeneca’s vaccines for most adults, potentially delaying immunization rollout.

With a relatively light calendar, a refocus on the fundamentals may push the currency pair lower.

EUR/USD Technical Analysis

Euro/dollar remains in a short-term uptrend, setting higher highs and higher lows as shown on the four-hour chart. Momentum remains to the upside and the world’s most popular currency pair is holding above the 100 and 200 Simple Moving Averages. However, EUR/USD has failed to top the 200 SMA and the Relative Strength Index is still too close to 70 – near overbought conditions.

Some support awaits at 1.1890, the daily low, followed by 1.1860, which cushioned the pair on Thursday. It is followed by 1.1825, where the 100 SMA hits the price.

Resistance is at the April peak of 1.1925, followed by 1.1950 and 1.1990, the latter being a double top.

Bank to the Future: Interest rates return to market center stage