- EUR/USD has been extending its losses, falling to the lowest since mid-December.

- The dollar is moving alongside yields, boosted by President-elect Biden and awaiting Fed Chair Powell.

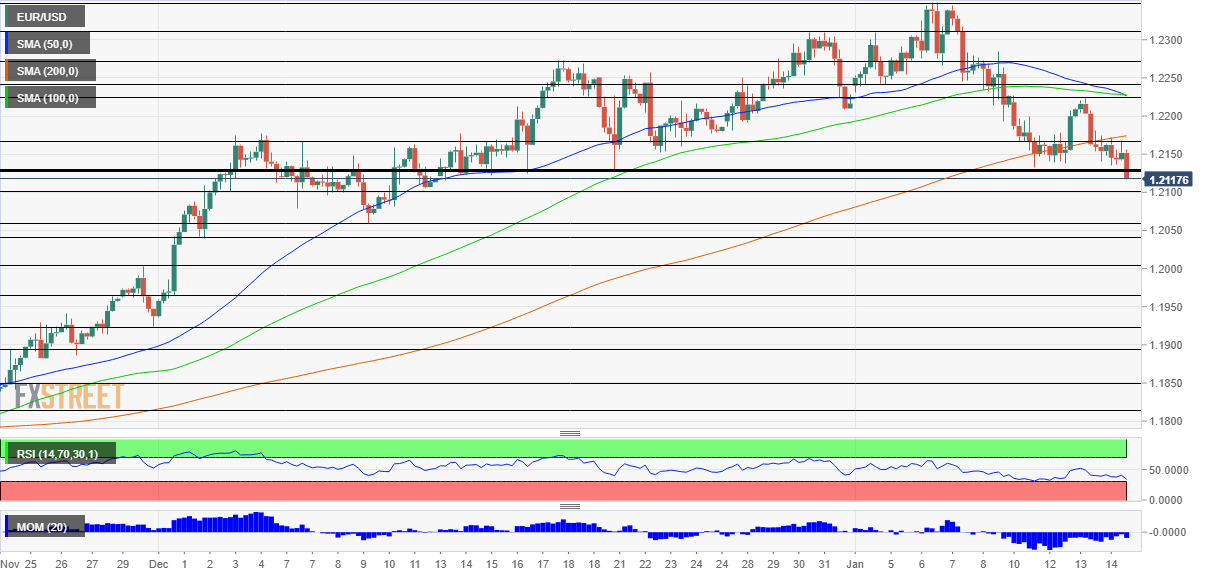

- Thursday’s four-hour chart is pointing to further losses.

If at first, you do not succeed, try, try again – EUR/USD bears pushed against 1.2125 and was rejected three times until now. The currency pair has breached the triple bottom in a move driven solely by the dollar.

The greenback has been gaining ground alongside rising US bond yields. The background is an upcoming speech by President-elect Joe Biden, in which he is expected to unveil a stimulus plan worth around $2 trillion – more than originally expected. In expectation of more debt issuance – and more robust economic growth – investors rotated from bonds to stocks. The resulting increase in yields made the dollar more attractive.

Will the central bank scoop up more debt? Jerome Powell, Chairman of the Federal Reserve, speaks later in the day and may provide hints if he prepares to increase the bank’s bond-buying scheme. However, speculation is mounting that the Fed could reduce it as economic expansion allows for higher long-term interest rates. His words are set to determine the next moves in the dollar.

Five factors moving the US dollar in 2021 and not necessarily to the downside

US jobless claims figures badly disappointed with a rise to 965,000 compared with fewer than 800,000 projected – yet the news failed to halt the dollar’s advance.

Elsewhere, the European Central Bank’s meeting minutes showed that the Frankfurt-based institution preferred expanding its own debt purchasing scheme in December over cutting rates. The move supported the euro back then and echoing that stance had little effect on Thursday.

The German economy has likely contracted by around 5% in 2020 according to initial estimates and Italy’s government is suffering a political crisis. These developments only add to the euro’s suffering.

Overall, there are reasons to see further falls, yet Powell has the power to change the pair’s course.

EUR/USD Technical Analysis

Euro/dollar has connivingly dropped below the 200 Simple Moving Average on the four-hour chart and continues suffering from downside momentum. The recent decline has yet to push the Relative Strength Index below 30, to oversold territory. All in all, bears are in control.

The next cushion is close – the round 1.21 level provided support in early December. Further down, 1.2060 was a swing low, and it is closely followed by 1.2045, a stepping stone on the way up.

Above 1.2125, the next level to watch is 1.2170, the daily high. It is followed by 1.2222, the weekly peak, and then by 1.2245.

EUR/USD Price Forecast 2021: Euro-dollar long-term bullish breakout points to 1.2750