- EUR/USD loses further ground and tests the 1.1625/20 band.

- Focus of attention remains on Tuesday’s US elections.

- Final German manufacturing PMI came in at 58.0 in October.

The selling bias around the single currency remains well in place for yet another session on Monday and drags EUR/USD to fresh 2-month lows in the 1.1620 region, where some decent contention appears to have emerged so far.

EUR/USD looks to data, US politics

EUR/USD struggles for direction in the lower bound of the current range and looks to reverse five consecutive daily pullbacks at the beginning of the week.

Increasing cautiousness ahead of the US presidential elections due on Tuesday gives extra oxygen to the safe haven universe, while rising coronavirus cases and fresh restrictions across Europe continue to weigh on the region’s economic projections and therefore underpinning the selling bias in the euro.

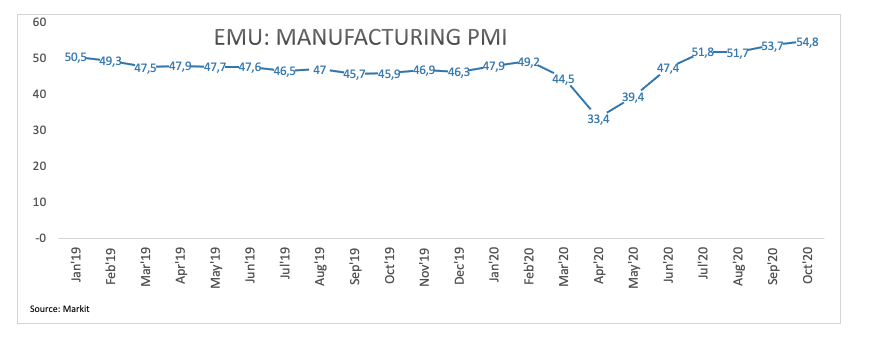

Earlier on Monday, final manufacturing PMI in Germany came in at 58.2 for the month of October, a tad above the preliminary prints. In the broader Euroland, the final PMI also surprised to the upside at 54.8, confirming the upbeat morale around the manufacturing sector.

Later in the NA session, the focus of attention while be on the October’s ISM Manufacturing results and final prints from the Markit’s gauge.

What to look for around EUR

EUR/USD sheds further ground and revisits the low-1.1600s against the backdrop of a persistent inflows into the safe haven universe. Despite the move lower, the outlook on EUR/USD still remains positive and so far propped up by auspicious results from domestic fundamentals (despite momentum appears somewhat mitigated in several regions), although the now dovish stance from the ECB could favour extra weakness in the short-term. Supporting the euro still remains the solid position of the EMU’s current account. In addition, the probable “blue wave” following the US elections is deemed as a negative driver for the greenback and carries the potential to lend some legs to occasional bullish attempts in the pair in the longer run.

EUR/USD levels to watch

At the moment, the pair is up 0.02% at 1.1647 and faces the next support at 1.1622 (monthly low Nov.2) followed by 1.1612 (monthly low Sep.25) and finally 1.1495 (monthly high Mar.9). On the other hand, a breakout of 1.1880 (monthly high Oct.21) would target 1.1917 (high Sep.10) en route to 1.1965 (monthly high Aug.18).