- EUR/USD accelerates the downside to the 1.1870 region.

- Next on the downside comes in the key 200-day SMA.

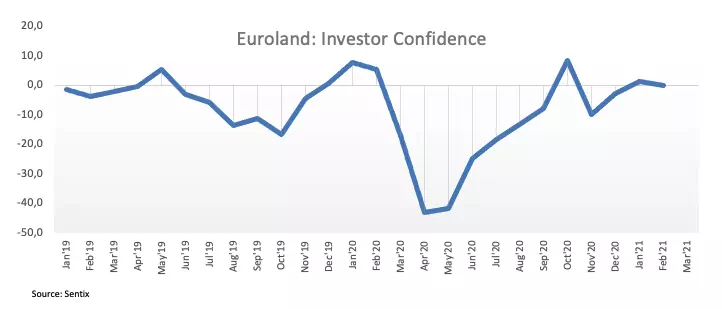

- The Sentix Index improved to 1.9 in March.

Sellers continue in total control of the sentiment around the single currency and drag EUR/USD to fresh multi-month lows in the 1.1870 region on Monday.

EUR/USD in multi-month lows

EUR/USD retreats for the fourth consecutive session at the beginning of the week and extend the recent breakdown of the key barrier at 1.19 the figure.

The improvement surrounding the greenback picks up extra pace, always underpinned by the expected outperformance of the US economy vs. its G10 peers, which is in turn supported by the slow pace of the vaccine rollout in the Old Continent (when compared to the US, UK).

In addition, the risk complex continues to suffer the sharp upside momentum in US (nominal and real) yields amidst investors’ rising perception of higher US inflation in the next months, mainly due to the increased fiscal spending. On the latter, it is worth mentioning that the US Senate passed the $1.9 trillion stimulus package on Saturday and it expected to be signed by President Biden at some point later this week.

In the euro calendar, the Investor Confidence gauged by the Sentix Index improved to 5.0 for the current month (from -0.2), surpassing initial estimates (1.9).

Data across the pond will only see the monthly figures for Wholesale Inventories for the month of January.

What to look for around EUR

EUR/USD navigates the area of new 2021 lows in the 1.1870 region. The solid rebound in the greenback as of late put the previous constructive stance in the euro under heavy pressure, as market participants continue to adjust to higher US yields and the outperformance of the US economy. A move below the critical 200-day SMA (around 1.1800) should shift the pair’s outlook to bearish in the near-term. In the meantime, price action around EUR/USD is expected to exclusively gyrate around the dollar’s dynamics, developments from yields on both sides of the ocean, extra fiscal stimulus in the US and the global economic recovery.

Key events in Euroland this week: Flash Q4 GDP (Tuesday) – ECB interest rate decision/Press Conference/Economic Projections (Thursday) – EMU’s Industrial Production (Friday).

Eminent issues on the back boiler: EUR appreciation could trigger ECB verbal intervention, always amidst the current (and future) context of subdued inflation. Potential political effervescence around the EU Recovery Fund. Huge long positions in the speculative community.

EUR/USD levels to watch

At the moment, the index is retreating 0.34% at 1.1867 and faces the next support at 1.1812 (200-day SMA) followed by 1.1762 (78.6% Fibo of the November-January rally) and finally 1.1602 (monthly low Nov.4 2020). On the flip side, a break above 1.1976 (50% Fibo of the November-January rally) would target 1.2029 (100-say SMA) en route to 1.2113 (monthly high Mar.3).