- EUR/USD sheds further ground and looks to 1.2000.

- The rebound in the greenback weighs on the pair.

- Fed’s Powell will take centre stage later in the NA session.

The selling pressure around the European currency extends for another session and drags EUR/USD to new daily lows in the 1.2030 region.

EUR/USD risks a move to 1.2000

EUR/USD loses ground for the second session in a row on the back of the persistent upside momentum surrounding the greenback.

In fact, the reflation/vaccine trade appears to have lost traction as a major driver for the risk complex. Indeed, the slow pace in the vaccine rollout in the Old Continent (vs. the US) threatens to cool down expectations of a strong economic recovery in the region.

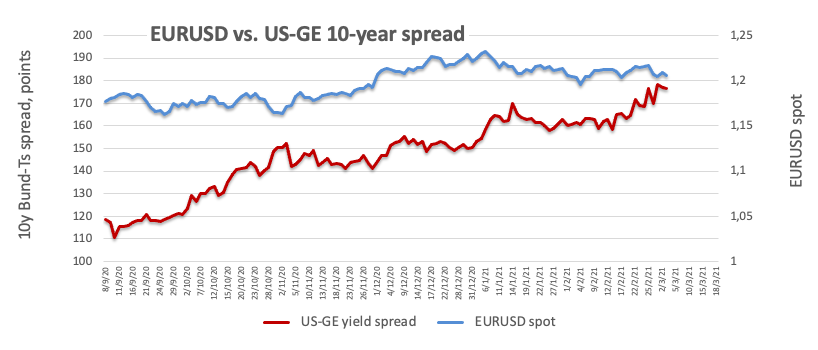

In addition, potential higher inflation following the planned extra fiscal stimulus by the Biden’s administration continue to lend oxygen to US yields and support the dollar’s upside momentum.

In the euro docket, Retail Sales in the broader Euroland will be the only release of note along with the Unemployment Rate, both readings for the month of January.

Across the pond, Chief Powell will participate in the event “Conversation on the US Economy” at The Wall Street Journal Jobs Summit. Later in the session, Initial Claims are due seconded by Unit Labor Costs, Nonfarm Productivity and Factory Orders.

What to look for around EUR

EUR/USD fails to gather serious upside traction and remains under pressure well below the 1.2100 barrier. The underlying bullish sentiment in the euro has lost strength in past sessions amidst investors’ adjustment to potential US inflation and the subsequent increase in yields and the demand for the dollar. Looking at the medium/longer-run, the outlook for the pair remains constructive on the back of prospects of extra fiscal stimulus in the US, real interest rates favouring Europe vs. the US and hopes of a solid economic rebound in the next months.

Key events in Euroland this week: EMU’s Retail Sales, Unemployment Rate (Thursday).

Eminent issues on the back boiler: EUR appreciation could trigger ECB verbal intervention, always amidst the current (and future) context of subdued inflation. Potential political effervescence around the EU Recovery Fund. Huge long positions in the speculative community.

EUR/USD levels to watch

At the moment, the index is retreating 0.22% at 1.2035 and faces the next support at 1.1991 (weekly low Mar.2) followed by 1.1976 (50% Fibo of the November-January rally) and finally 1.1952 (2021 low Feb.5). On the flip side, a break above 1.2136 (50-day SMA) would target 1.2243 (weekly high Dec.17) en route to 1.2349 (2021 high Jan.6).