- EUR/USD adds to recent losses in the 1.2040 region.

- German/EMU final Manufacturing PMI surpassed estimates.

- ECB-speak, ISM Manufacturing next on tap in the docket.

The offered bias remains well and sound around the single currency and drags EUR/USD to fresh daily lows in the 1.2040/35 band at the beginning of the week.

EUR/USD weaker on USD-strength

EUR/USD drops to new multi-day lows, extends the recent breakdown of the 1.2100 mark and opens the door to a deeper pullback and a potential re-test of the psychological support at 1.20 the figure in the short-term horizon.

In fact, the dollar keeps the upside note unchanged so far and extends the recent recovery on the back of higher US yields, as investors continue to perceive the impact of the probable extra US fiscal stimulus as inflationary.

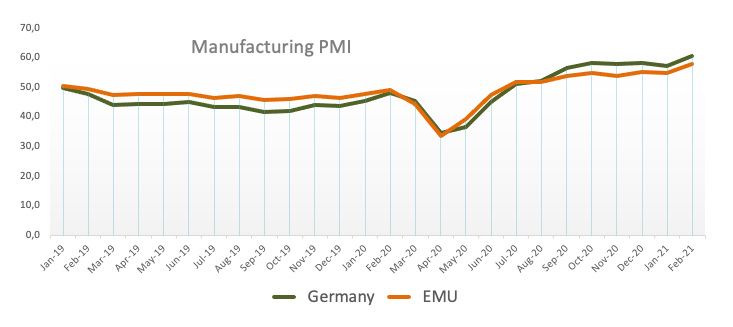

In addition, the euro fails to garner support from the better-than-expected results from the final Manufacturing PMI in both Germany (60.7) and the broader Euroland (57.9) for the month of February.

Later in the calendar, advanced CPI figures in Italy and Germany are due ahead of speeches by ECB’s L. De Guindos and C.Lagarde.

Across the pond, the ISM Manufacturing will be the salient event followed by Markit’s final PMIs for the month of February and the speech by FOMC’s permanent voter L.Brainard (dovish).

What to look for around EUR

EUR/USD continues its march south after being rejected from recent peaks in the 1.2240 region. The underlying bullish sentiment in the euro remains under pressure for the time being amidst investors’ adjustment to potential US inflation and the subsequent increase in yields and the demand for the dollar. Looking at the medium/longer-run, the outlook for the pair remains constructive on the back of prospects of extra fiscal stimulus in the US, real interest rates favouring Europe vs. the US and hopes of a solid economic rebound in the next months.

Key events in Euroland this week: German flash March CPI, ECB’s Lagarde (Monday) – German labour market report and EMU’s advanced March CPI (Tuesday).

Eminent issues on the back boiler: EUR appreciation could trigger ECB verbal intervention, always on inflation issues. EU Recovery Fund. Huge long positions in the speculative community.

EUR/USD levels to watch

At the moment, the index is losing 0.28% at 1.2036 and faces immediate contention at 1.2023 (weekly low Feb.17) followed by 1.2018 (100-day SMA) and finally 1.1952 (2021 low Feb.5). On the upside, a breakout of 1.2243 (weekly high Dec.17) would target 1.2349 (2021 high Jan.6) en route to 1.2413 (monthly high Apr.17 2018).