- EUR/USD plummets to fresh multi-day lows near 1.1180.

- EMU Economic Sentiment dropped to -20.2 in June.

- EMU final May CPI rose 1.2% YoY. Core CPI rose 0.8%.

The sentiment around the shared currency keeps deteriorating so far today and is now sending EUR/USD to clinch fresh 2-week lows in the 1.1180 region.

EUR/USD offered on data, Draghi

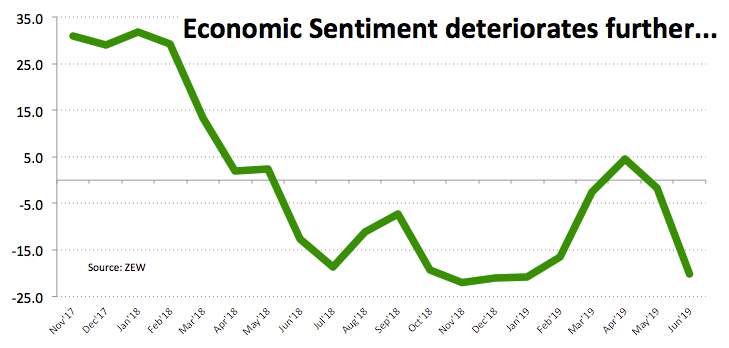

The pair lost further momentum after the ZEW survey disappointed expectations for the current month, in line with previous gauges of sentiment and confidence in the region.

In fact, the Economic Sentiment in the broader Euroland fell to -20.2, while the same gauge in Germany tumbled to -21.1. In addition German Current Conditions surprised to the upside at 7.8, albeit easing from May’s 8.2.

Further data in the euro area saw headline consumer prices rising 1.2% on a year to May, while consumer prices stripping food and energy costs rose 0.8% from a year earlier.

In the meantime, EUR remains well into the negative territory today following the dovish appreciations from President Mario Draghi at the ECB Forum in Sintra followed by the above-mentioned data releases.

EUR/USD levels to watch

At the moment, the pair is retreating 0.29% at 1.1185 facing immediate contention at 1.1181 (low Jun.18) seconded by 1.1176 (monthly low Mar.7) and finally 1.1115 (low May 30). On the upside, a breakout of 1.1347 (high Jun.7) would target 1.1356 (200-day SMA) en route to 1.1448 (monthly high Mar.20).