- EUR/USD fades the earlier advance to the 1.2180 region.

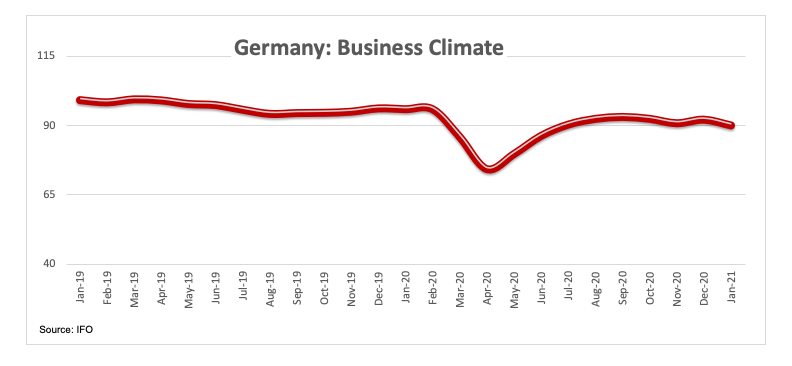

- German IFO Business Climate receded to 90.1 in January.

- ECB’s Lagarde, Panetta, Lane, Elderson due to speak later.

Following a move to tops beyond 1.2180 during early trade, EUR/USD run out of steam and now deflates to the 1.2150/40 band, or daily lows.

EUR/USD weaker post-German data

EUR/USD loses upside momentum at the beginning of the week after the German IFO survey disappointed market expectations for the month of January. Indeed, the Business Climate eased to 90.1, Current Assessment dropped to 89.2 and Business Expectations retreated to 91.1, all prints coming in below estimates and showing some loss of morale among participants.

The lower-than-forecast prints also reflect the impact of the pick-up in coronavirus cases in Germany as well as the fresh restriction measures re-implemented in order to fight the pandemic.

In the meantime, the planned US $1.9 trillion stimulus package seems to be facing some headwinds from policymakers, particularly regarding to its (huge) size, and is also denting the sentiment in the risk complex so far on Monday.

In the docket, ECB President Lagarde will speak at the virtual Davos Forum on “Restoring Economic Growth”. Additionally, ECB’s Board members Lane, Panetta and Elderson are also due to speak later in the session.

What to look for around EUR

The recovery in EUR/USD managed to reach the area just below the 1.2200 mark last Friday. While downside pressure looks somewhat mitigated for the time being, the outlook for EUR/USD remains constructive and appears supported by prospects of a strong recovery in the region (and abroad), which is in turn underpinned by extra fiscal stimulus by the Fed and the ECB. In addition, real interest rates continue to favour the euro area vs. the US, which is also another factor supporting the EUR along with the huge, long positioning in the speculative community.

EUR/USD levels to watch

At the moment, the pair is losing 0.22% at 1.2144 and faces the next support at 1.2076 (55-day SMA) seconded by 1.2053 (2021 low Jan.18) and finally 1.1976 (50% Fibo of the November-January rally). On the upside, a break above 1.2189 (weekly high Jan.22) would target 2349 (2021 high Jan.6) en route to 1.2413 (monthly high Apr.17 2018).