- The pair loses the grip and breaks below 1.1300, fresh lows.

- The greenback gathers extra oxygen and climbs to 96.70/75.

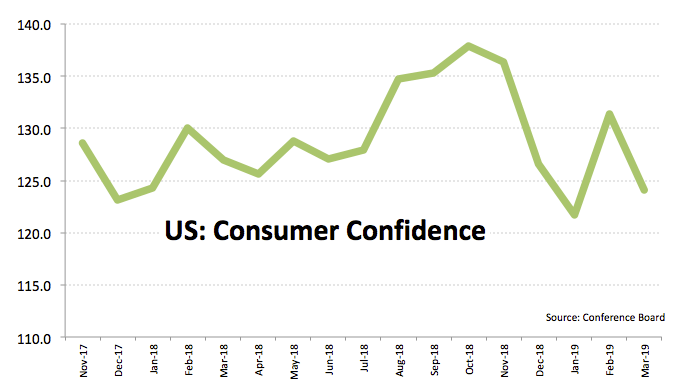

- US Consumer Confidence came in at 124.1 in March.

The downside pressure around the European currency has now intensified and forced EUR/USD to print weekly lows near 1.1280.

EUR/USD challenges recent lows near 1.1270

The pair is now losing ground for the second consecutive week after failing to break above the critical 200-week SMA on a convincing fashion, sparking instead the ongoing knee-jerk to the 1.1280 region and below.

The sudden down move in spot came in response to the pick up in the demand for the greenback on the back of the continuation of the upside momentum in USD/JPY, which is trading in fresh 2-day highs.

In the data space, the US housing sector deteriorated further today after poor prints from Housing Starts and Building Permits along with the lower-than expected expansion in house prices gauged by the S&P/Case-Shiller index. In addition, Consumer Confidence tracked by the Conference Board surprised to the downside in March at 124.1.

What to look for around EUR

Market participants have left behind the recent and renewed dovish stance from the ECB, focusing instead on the broad risk-appetite trends, USD-dynamics and domestic data. Regarding the latter, and looking to the broader picture, the view of a slowdown in the bloc has been ‘confirmed’ last week following disappointing advanced PMIs in core Euroland. This, in turn, should add to the idea of a ‘patient for longer’ stance from the ECB. On the political front, headwinds are expected to emerge in light of the upcoming EU parliamentary elections, where the focus of attention will be on the potential increase of the populist option among voters.

EUR/USD levels to watch

At the moment, the pair is retreating 0.19% at 1.1289 and faces immediate contention at 1.1273 (low Mar.22) seconded by 1.1234 (low Feb.15) and finally 1.1215 (2018 low Nov.12). On the flip side, a break above 1.1357 (55-day SMA) would target 1.1363 (100-day SMA) en route to 1.1448 (high Mar.20).