- The selling mood around the pair remains well and sound on Tuesday.

- The greenback stays firm and re-targets the 96.00 handle and above.

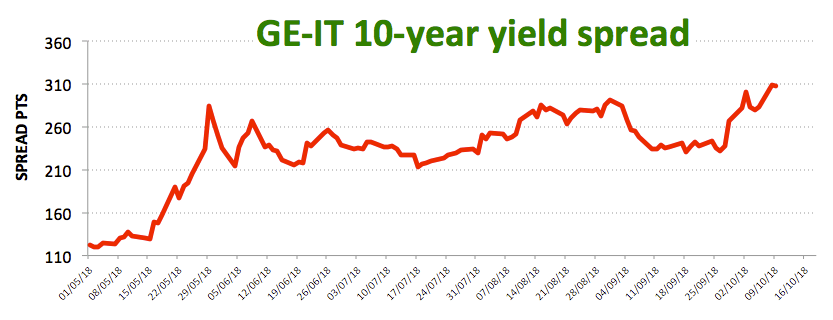

- Italy and rising yields keep driving the sentiment.

The single currency remains under pressure so far this week and is now forcing EUR/USD to fade the initial optimism and return to the negative ground.

EUR/USD looks to Italy, yields

Spot resumed the downside after a failed bullish attempt to the 1.1500 neighbourhood, always on the back of persistent concerns over the Italian fiscal front, where the budget remains in centre stage.

Collaborating with the downside in the pair, yields in the Italian fixed income markets keep surging and widening the spread vs. their German peers. Recent comments by Lega’s M.Salvini noted there are no intentions to revise the government plans for fiscal expansion.

The prevailing risk-off mood has been lending extra wings to the greenback, motivating the US Dollar Index to extend the rally and trade closer to the key 96.00 milestone.

In the data space, it German trade surplus widened to €18.3 billion in August, surpassing estimates. Later in the day, US NFIB index and the IBD/TIPP index are due along with the speech by Chicago Fed C.Evans.

EUR/USD levels to watch

At the moment, the pair is losing 0.10% at 1.1481 facing the next support at 1.1460 (low Oct.8) seconded by 1.1449 (50% Fibo of the 2017-2018 up move) and finally 1.1299 (2018 low Aug.15). On the flip side, a break above 1.1542 (high Oct.4) would target 1.1561 (10-day SMA) en route to 1.1630 (21-day SMA).