- EUR/USD trades on the defensive below the 1.1150 level.

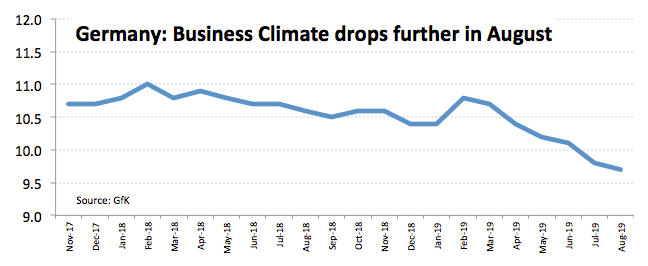

- German GfK Consumer Climate came in at 9.7 in August.

- US Core PCE, CB’s Consumer Confidence next of relevance.

The single currency is fading yesterday’s gains and is now taking EUR/USD to the 1.1140/35 band.

EUR/USD now looks to data, trade, Fed

The pair is prolonging the choppy trade in the lower bound of the recent range amidst the continuation of the buying bias around the greenback and German yields trading near record lows.

In the meantime, occasional bullish attempts in spot are expected to be short-lived against the backdrop of firm expectations of further easing by the ECB as early as in September. In the very near term, spot is seen under pressure as tomorrow’s FOMC event could be less dovish that initially estimated, supporting further the rally in the buck.

On the trade front, US and Chinese negotiators will meet today and tomorrow in Shanghai to resume talks, although both parties have already ruled out further progress on the way to a final deal.

In the data space, the German Business Climate tracked by GfK matched forecasts at 9.7 for the month of August (from 9.8) while French advanced GDP figures noted the economy is expected to expand at a quarterly 0.2% during the April-June period.

Later in the day, Consumer Confidence and Business Climate in the broader euro area are due ahead of key flash inflation figures in Germany. Across the pond, the publication of Core PCE figures and Consumer Confidence will be in centre stage.

What to look for around EUR

The single currency is expected to remain under scrutiny in the next weeks amidst ECB’s preparations for a fresh wave of monetary stimulus, including a potential reduction of interest rates, the re-start of the QE programme and a probable tiered deposit rate system. The ECB has already changed its forward guidance and it now expects rates to remain at ‘present or lower levels’ until at least mid-2020. The unremitting deterioration of the economic outlook in the region and the lack of traction in inflation are seen limiting any occasional bullish attempts in EUR for the time being and also give extra sustain to the dovish stance in the ECB.

EUR/USD levels to watch

At the moment, the pair is losing 0.07% at 1.1136 and faces immediate contention at 1.1101 (2019 low Jul.25) seconded by 1.1021 (high May 8 2017) and finally 1.0839 (monthly low May 11 2017). On the upside, a break above 1.1233 (55-day SMA) would target 1.1286 (high Jul.11) en route to 1.1304 (200-day SMA).