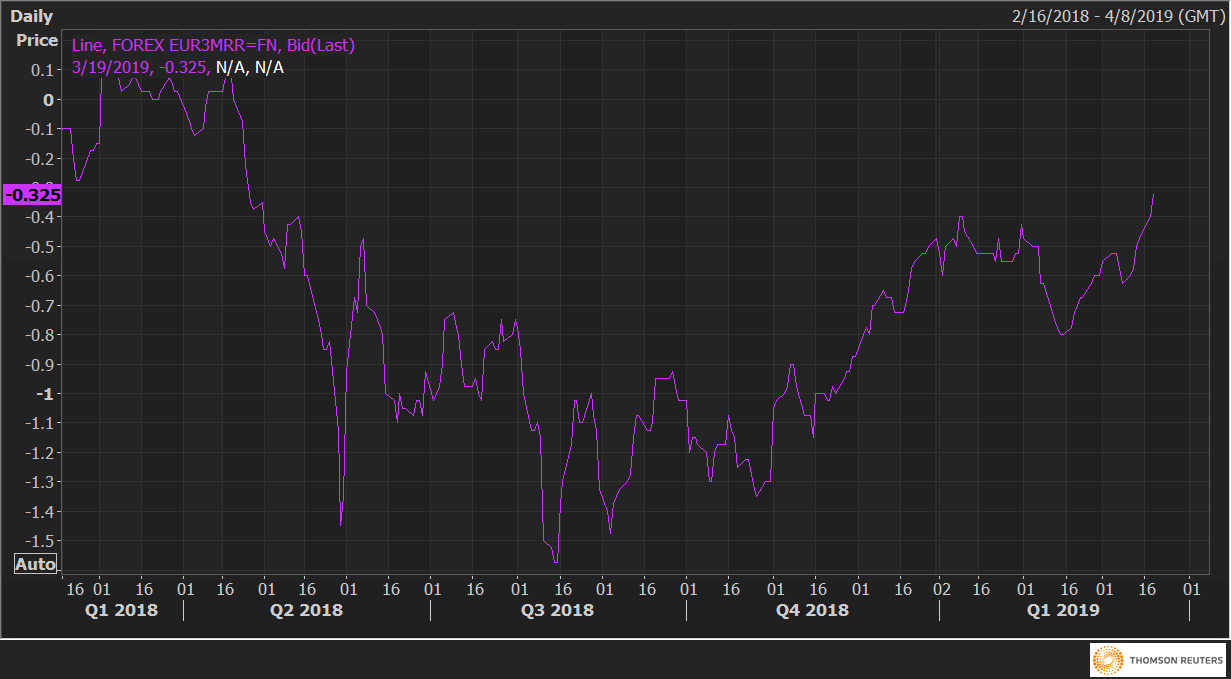

- Three-month EUR/USD risk reversals (EUR3MRR) have hit 11-month highs, signaling the bearish sentiment is weakest since April 2018.

- EUR/USD may challenge 1.14 if the German Zew survey indices, due for release today, beat estimates.

The value of the bearish bets on EUR/USD in the options market has hit an 11-month low ahead of the all-important FOMC rate decision, scheduled tomorrow.

Three-month risk reversals on the shared currency, a gauge of calls to puts, are currently seen at -0.325 – the highest level since April 25, 2018.

Indeed, the negative number indicates the demand or the implied volatility premium for puts (bearish bets) still outstrips the demand for calls (bullish bets). The gauge, however, is currently at an 11-month high, meaning the value of puts is at an 11-month low.

Put simply, the bearish sentiment on EUR/USD is the weakest since April 2018.

It appears the investors are preparing for a dovish Fed. The US central bank is widely expected to keep rates unchanged tomorrow and signal reduced inclination to hike rates.

As for today, the focus is on the German Zew survey indices, scheduled for release at 10:00 GMT.

EUR/USD is currently mildly bid at 1.1349 and could rise well above 1.1367 (78.6% Fib R of 1.1420/1.1176) if the Zew survey – economic sentiment index for March prints above estimates, alleviating fears of a deeper slowdown in the Eurozone’s largest economy.

Technical Levels

Resistance: 1.1367 (78.6% Fib R of 1.1420/1.1176), 1.13292 (trendline connecting Jan. 10 and Jan. 31 high), 1.1420 (Feb. 28 high).

Support: 1.1327 (5-day moving average), 1.1290 (10-day moving average), 1.1234 (Feb. 15 low).

EUR3MRR