- EUR/USD risk reversals jumped to the highest since June 7, indicating falling demand for puts (bearish bets).

- Eurozone third quarter GDP, due for release at 10:00 GMT, is expected to show that growth rate remained unchanged.

- A better-than-expected US average weekly earnings could push up Treasury yields and the US dollar.

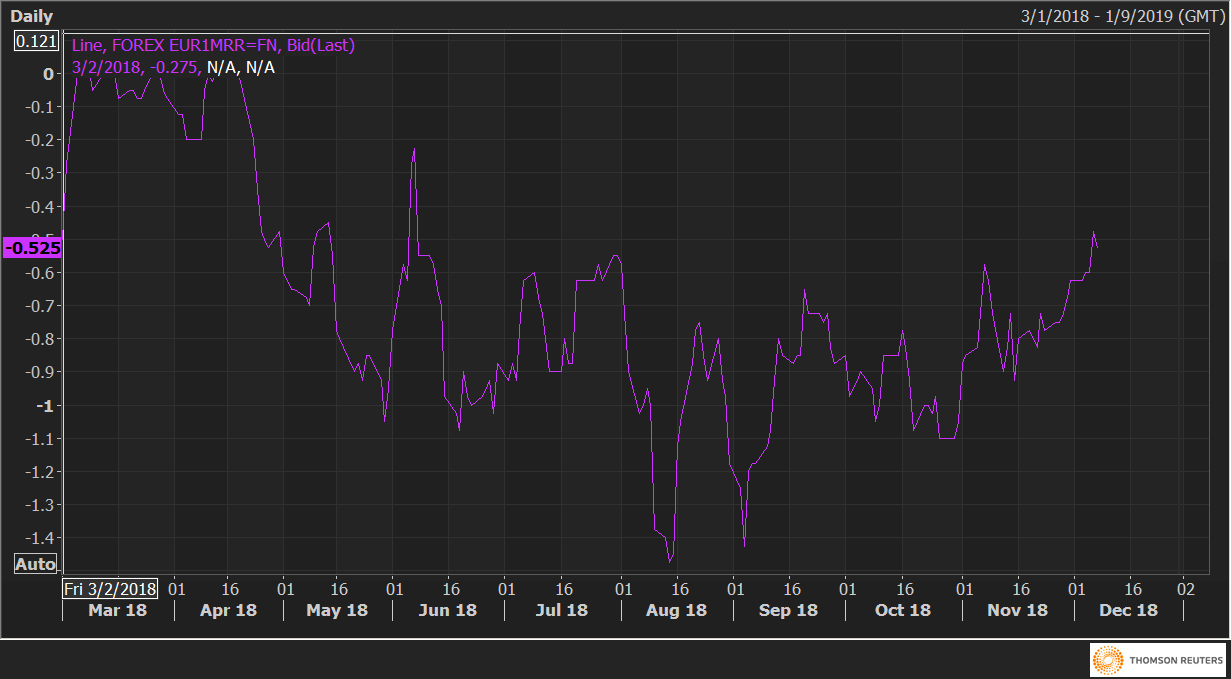

Risk reversals on the EUR, a gauge of calls to puts on the common currency, rose to six-month highs on Thursday, indicating investors are trimming bearish bets in anticipation of a stronger rally.

The one-month 25 delta risk reversals (EUR1MRR) rose to -0.475 – the highest level since June 7. The negative print indicates the implied volatility premium (or demand) for the puts (bearish bets) is higher than that for calls (bullish bets).

The value for the puts, however, is at the lowest in six months. Notably, it has dropped sharply in the last three weeks – risk reversals stood at -0.925 on Nov. 15.

So, it seems safe to say that investors are likely expecting the EUR/USD to confirm a symmetrical triangle breakout with a move above 1.1433 (upper edge of the triangle) and hence are unwinding bearish positions.

The bullish move could happen today if the Eurozone GDP prints above estimates and more importantly, the US wage growth cools sharply, forcing the markets to price in a 2019 rate pause. As of now, markets are expecting the Fed to deliver one rate hike next year.

The bull breakout, however, will likely remain elusive if the US wage growth number blows past expectations, pushing the treasury yields higher. The dollar may also remain bid if equities remain risk-averse.

EUR1MRR

EUR/USD Technical Levels

EUR/USD

Overview:

Today Last Price: 1.1375

Today Daily change: -7.0 pips

Today Daily change %: -0.0615%

Today Daily Open: 1.1382

Trends:

Previous Daily SMA20: 1.1349

Previous Daily SMA50: 1.1421

Previous Daily SMA100: 1.1518

Previous Daily SMA200: 1.1746

Levels:

Previous Daily High: 1.1413

Previous Daily Low: 1.1321

Previous Weekly High: 1.1402

Previous Weekly Low: 1.1267

Previous Monthly High: 1.15

Previous Monthly Low: 1.1216

Previous Daily Fibonacci 38.2%: 1.1378

Previous Daily Fibonacci 61.8%: 1.1356

Previous Daily Pivot Point S1: 1.1331

Previous Daily Pivot Point S2: 1.128

Previous Daily Pivot Point S3: 1.124

Previous Daily Pivot Point R1: 1.1423

Previous Daily Pivot Point R2: 1.1464

Previous Daily Pivot Point R3: 1.1515