- The pair fades the earlier spike to the 1.1730 region.

- The greenback clinches fresh YTD tops near 94.40.

- Italian politics keep weighing on EUR sentiment. Elections after August.

After advancing to fresh daily highs around 1.1730, EUR/USD has sparked a sharp correction lower and is now challenging the key support at 1.1600 the figure.

EUR/USD weaker, keeps looking to Italy

The shared currency has accelerated the downside at the beginning of the week, fully (and quickly) fading the initial spike to the 1.1730 region on an ephemeral bullish attempt.

EUR remains entrenched into the negative territory, as uncertainty in the Italian political area does nothing but grows so far today. The shared currency reverted the initial optimism after the recently appointed PM G.Conte stepped down, while leaders of the M5S and Lega Nord are pushing for an impeachment of President S.Mattarella.

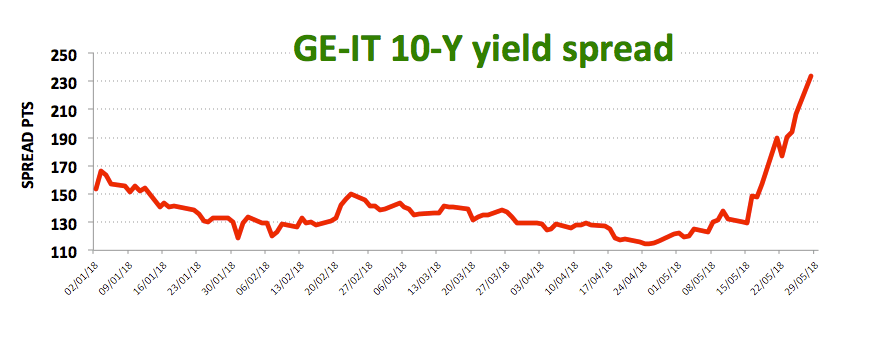

In addition, Italian stocks are navigating a sea of red led by the banking sector and the yield spread between Italian 10-year bond and German Bunds keep widening, all plotting against any recovery of spot.

EUR/USD levels to watch

At the moment, the pair is losing 0.30% at 1.1615 and a break below 1.1608 (2018 low May 28) would target 1.1600 (psychological level) en route to1.1553 (monthly low Nov.7). On the other hand, the next hurdle emerges at 1.1780 (10-day sma) seconded by 1.1829 (high May 22) and finally 1.1857 (21-day sma).