- The Euro strengthened against the US Dollar this week.

- The Dollar’s weakening was mainly due to the Fed’s announcements and a lower-than-expected GDP.

- A price consolidation is expected next week.

The EUR/USD weekly analysis shows the week’s close with an uptrend, reaching its highest point of the month this week, settling just below 1.1900. Throughout the week, the pair had a small uptrend that was accelerated after the disappointing announcements of the Fed, which caused a weakening of the US Dollar.

–Are you interested to learn more about buying cryptocurrencies? Check our detailed guide-

The Fed kept its monetary policy intact and said that the economy is progressing as expected, but it’s not yet at the point of making the desired changes that the market wants. However, Fed Chair, Jerome Powell, stressed that they are still expecting substantial progress, pointing out that such “substantial progress” will be linked to price stability and the level of maximum employment. As a result of these announcements, the US dollar weakened.

In addition to the disappointing announcements from the Fed, the economic data was worse than expected. The preliminary second-quarter GDP report showed growth of 6.5%, 2 points below the 8.5% anticipated. On the other hand, they corrected the first-quarter GDP, lowering the growth estimate to 6.3%.

Meanwhile, the EU is recovering. Germany managed to grow 1.5%, which is below the 2% expected but improves on the previous -2.1%. For the entire European Union, GDP grew 2% quarter-on-quarter, opposed to the registered -0.3% of the previous quarter. Unemployment rates also fell slightly, and the economic sentiment index rose.

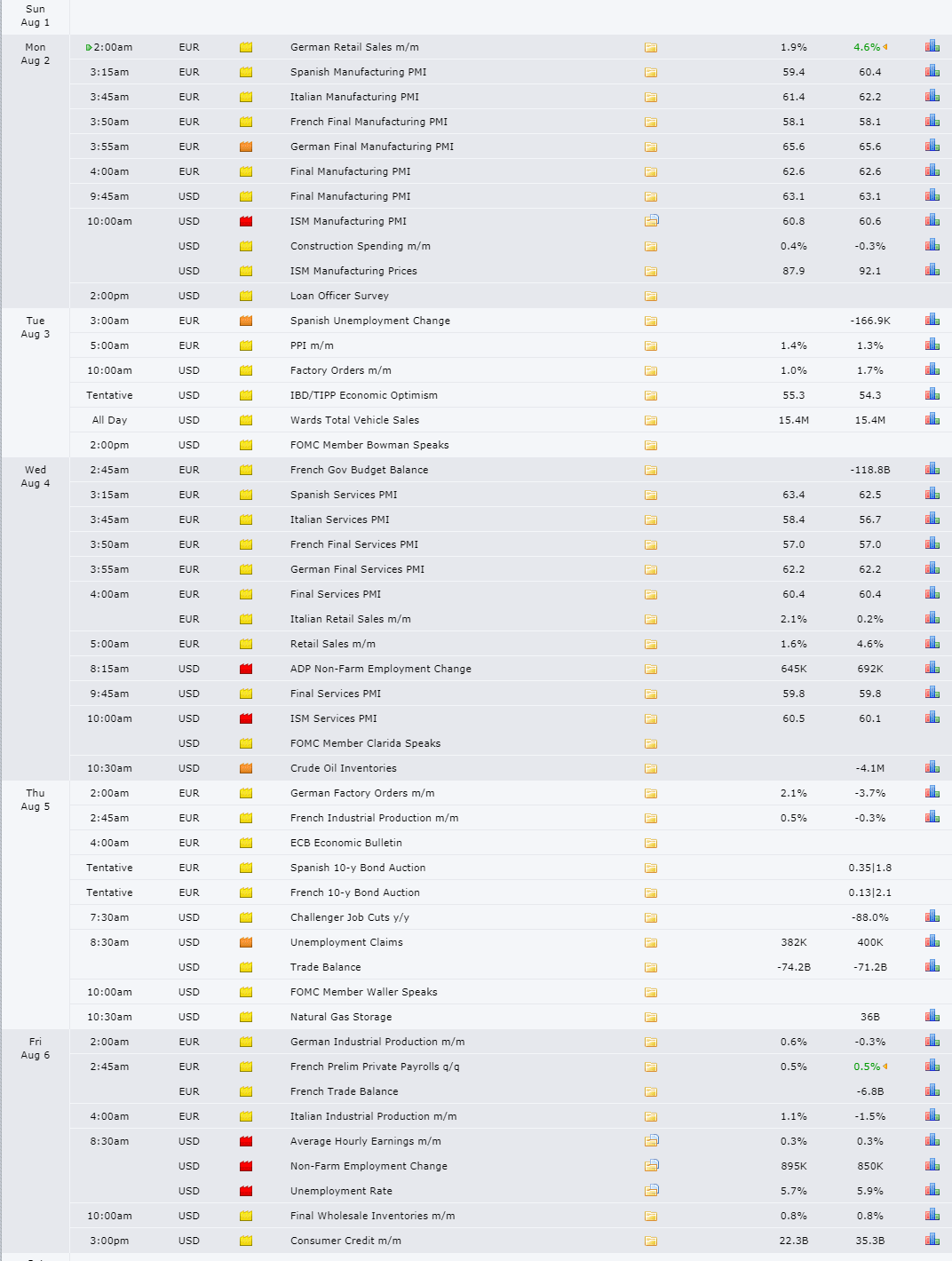

Upcoming events

This week’s behavior of the EUR/USD pair will be linked to the events of the US and German economies, which is the strongest economy in the eurozone. On the American side, the most relevant release will be unemployment data, while in Germany, the publication of retail sales, factory orders, and industrial production for June is expected.

The US NFP data due on Friday is also quite significant as the Fed also gauges employment data as a key for the monetary policy. The report is expected to reveal 925k jobs for July.

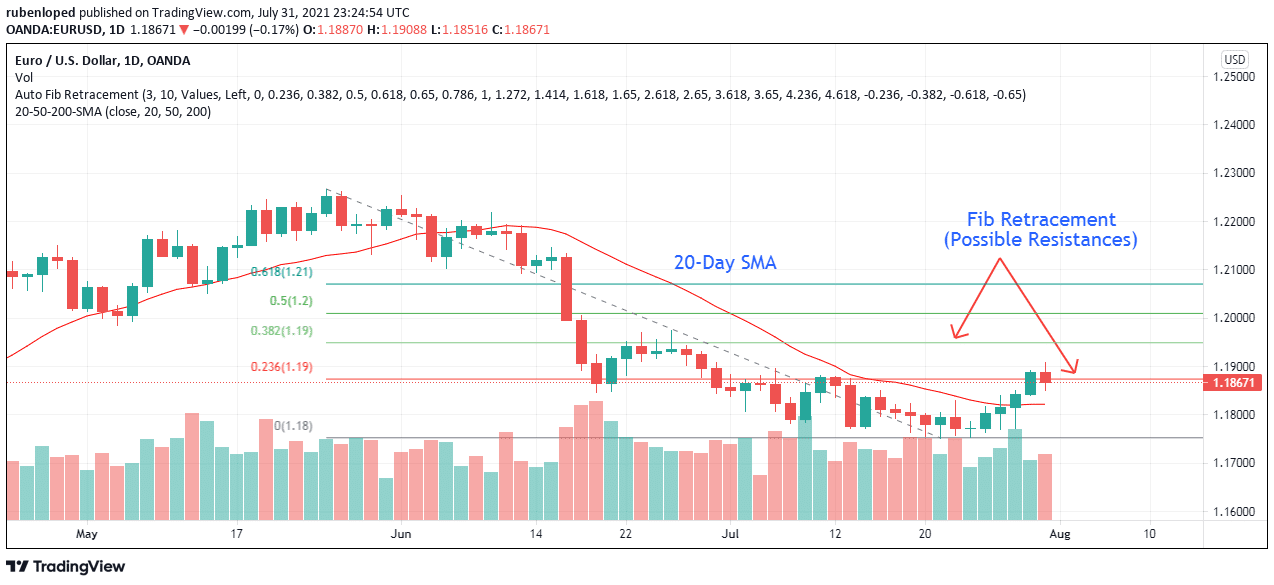

EUR/USD technical analysis: Fibonacci retracement sets resistance levels

Last week, the EUR/USD pair recovered due to what can be seen as a price correction from a greater perspective.

–Are you interested to learn more about forex robots? Check our detailed guide-

Technical indicators are at negative levels, and on the weekly chart, the 20 SMA continues with a bearish slope.

For the next week, the resistance levels are given by the Fibonacci retracements at the levels of 1.1920 and 1.1985, while the support levels are at 1.1840, 1.1751 (which is the monthly low), and finally, 1.1703 (which was the March’s Bottom).

EUR/USD forecast for next week: Consolidation above 1.1900

The EUR/USD will see a consolidation from current levels, and the trading average will be above 1.1900.

The moving averages turned higher. The weekly moving average also had an even stronger momentum indicating that the bulls are slowly making a comeback.

Looking to trade forex now? Invest at eToro!

67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.