- EUR/USD whiplashed after the FOMC meeting as investors had expected the 75bps rate hike.

- The Fed has promised to remain aggressive in fighting inflation.

- Bears are in charge of the daily chart.

The EUR/USD weekly forecast remains bearish as the Fed is not likely to loosen its aggressive monetary policy.

Ups and downs of EUR/USD

It has been a crazy week for EUR/USD, filled with volatility. The FOMC meeting caused a lot of this volatility.

-Are you interested in learning about the forex live calendar? Click here for details-

The Federal Reserve had its most significant interest rate hike in more than a quarter of a century and went on to say it would not be shaken by the rising risk of recession in its quest to tame inflation.

“We’re attacking inflation, and we’re going to do all that we can to get it back down to a more normal level, which for us has got to be 2%. We’ll do whatever it takes to make that happen.”

Atlanta Fed President Raphael Bostic told American Public Media’s Marketplace radio program.

Bostic had been singing a different tune three weeks ago on rapid rate hikes and said the Fed might need to loosen its policy in September to save the economy. On Friday, he said he was all for the hefty rate increase and that the Fed’s policy needs to be “more muscular.”

Next week’s key events for EUR/USD

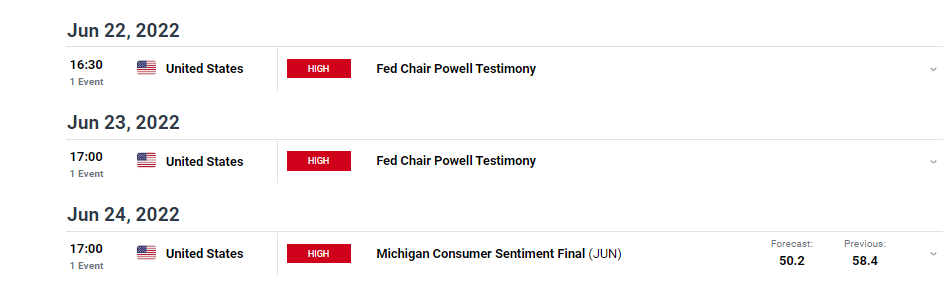

After a hectic week in the US that caused a lot of volatility for EUR/USD, next week will be relatively quiet. Investors will be listening in on Fed chair Powell, whose testimony is expected next week. There will also be the Michigan Consumer Sentiment Final for June, which is expected to drop.

EUR/USD weekly technical forecast:

The daily chart shows the price pushing higher after making a double bottom at 1.04000. The 22-SMA is trading sideways, showing that the price is currently ranging. Zooming in on the range, we see bears currently in charge of the market as the price is below the SMA and the RSI is trading below the 50 level.

-Are you interested in learning about forex signals? Click here for details-

The price is experiencing resistance at 1.06000 and could push lower in the coming week. Bulls will only take charge of this market if they can push the price above the 22-SMA and 1.06000. Until then, the bias for EUR/USD remains bearish.

Looking to trade forex now? Invest at eToro!

68% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money