- EUR/USD posted modest gains near and reached 1.1800 level last week.

- The uptrend is attributed to the weaker USD that was triggered on Wednesday.

- Europe’s data front is not healthier, though and may continue to cap the gains in Euro.

- Fed’s meeting minutes hold importance for the next week.

The weekly forecast for the EUR/USD is bullish amid Greenback weakness. However, the fundamental picture of the Euro is not quite healthy.

The EUR/USD pair ended the week with modest gains, albeit below 1.1800 and far off the 1.1705 low. Following the release of US inflation data on Wednesday, the prevailing downtrend halted. As expected, the CPI was confirmed at 5.4% YoY, while the base price was lowered to 4.3%. The still-high numbers indicate that inflation has peaked, so the US Federal Reserve is correct to slow down.

–Are you interested to learn more about day trading brokers? Check our detailed guide-

Nevertheless, the country’s PPI increased 7.8% from a year earlier, supporting speculation and halting the dollar’s fall. In addition, the number of weekly jobless claims fell to 375,000 in the first week of August as a result of an impressive July nonfarm payrolls report. The US Federal Reserve System has two mandates: price stability and maximum sustainable employment.

The central bank has tried to lower expectations by predicting that inflation will rise temporarily and that moderate gains in employment will support super-weak monetary policy. However, despite accelerating job growth, inflation may have finally peaked based on August’s figures. Therefore, once the August data turns upbeat again, the Fed won’t maintain its patient stance.

Europe’s bumpy road

As the pandemic overshadowed the economic recovery, the European Central Bank remained silent for weeks after European policymakers pledged to support “continuous adjustment” of monetary policy.

Additionally, the data from the European Union were tepid, to say the least. Economic sentiment in Germany fell to 40.4 in August and 42.7 in the EU, much worse than expected, according to a ZEW poll. CPI was confirmed at 3.8% y / y in July, while wholesale prices rose by 1.1% m / m. In addition, the EU announced industrial production data for June, which was unexpectedly down by 3% m / m. Positively, the EU’s trade balance showed a seasonally adjusted surplus of € 12.4 billion.

–Are you interested to learn more about forex bonuses? Check our detailed guide-

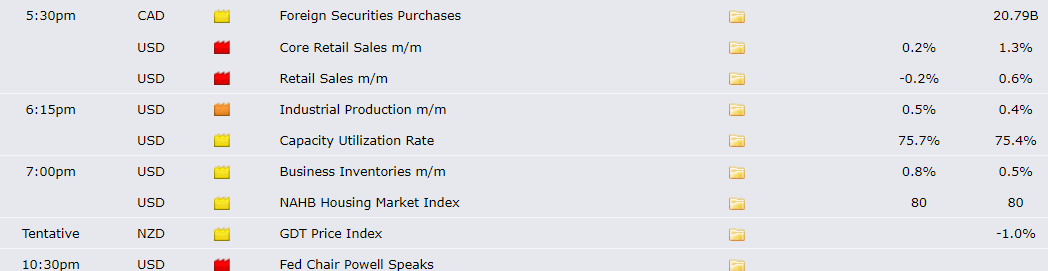

America’s key events during Aug 16-20

Next week, there will be some great macro events. Retail sales in the US are set to decline by 0.2% m/m on Tuesday. In addition, the Federal Reserve minutes of its most recent meeting will be released on Wednesday.

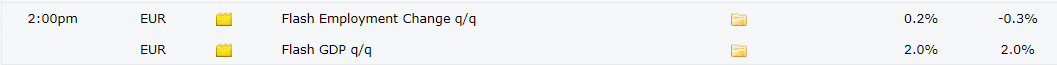

Eurozone’s key events during Aug 16-20

Forex market participants have not changed much as summer forces northern hemisphere traders to take a break from their computers. The macroeconomic calendar will continue to see some events over the next couple of days. Low volatility is expected to persist.

On Tuesday, the EU will release its second-quarter GDP, and the US will publish its retail sales for July, with the latter falling 0.2% m/m.

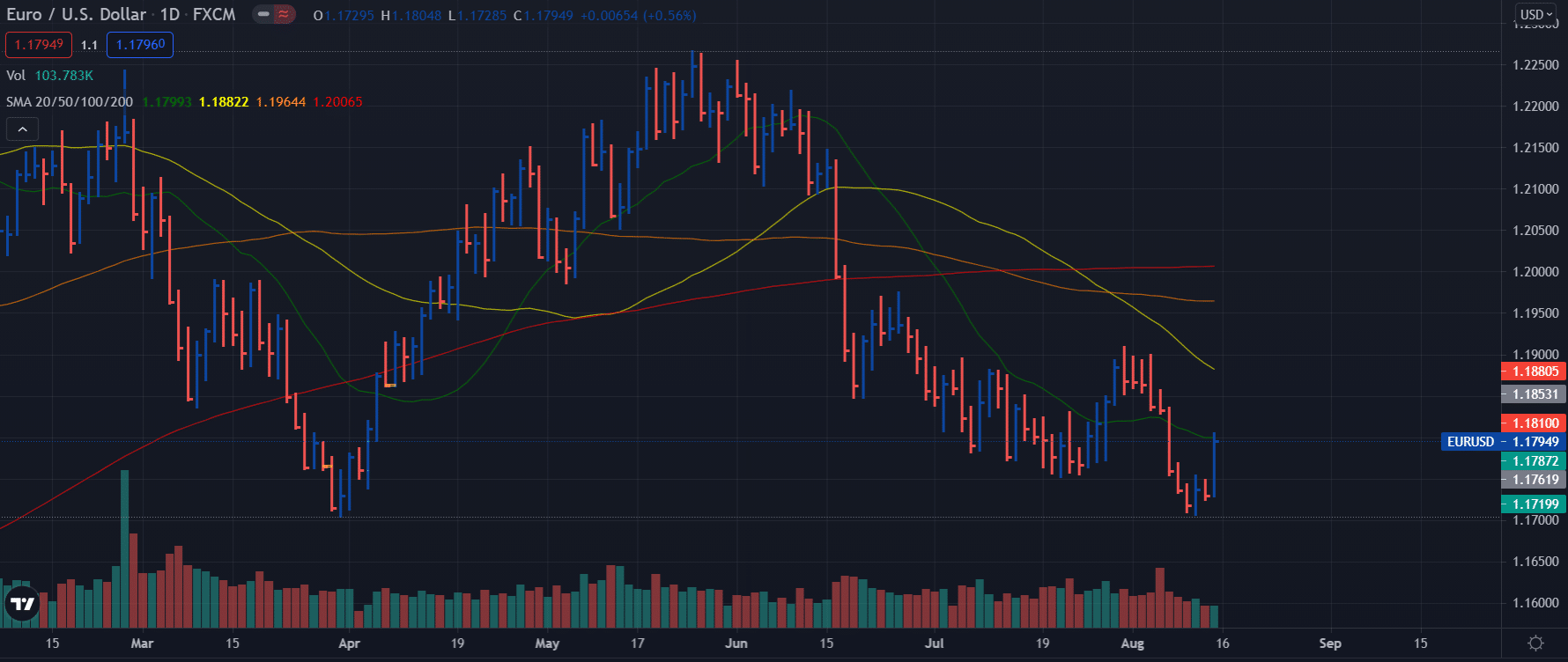

EUR/USD weekly technical forecast: Bulls capped by key DMAs

The EUR/USD pair gained traction on Friday, but the bulls are still below the key 2-day SMA and the psychological mark of 1.1800. The swing high of 1.1880 is also a key resistance ahead of multi-month highs of 1.1909. The 50, 100 and 200 DMAs are also above the price, which indicates a bearish trend. On the flip side, if the price fails to break 1.1800, it may plunge down to 1.1750 ahead of 1.1700.

Looking to trade forex now? Invest at eToro!

67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.