- Last week saw several positive US economic releases.

- The European Central Bank’s interest rates still have room to rise.

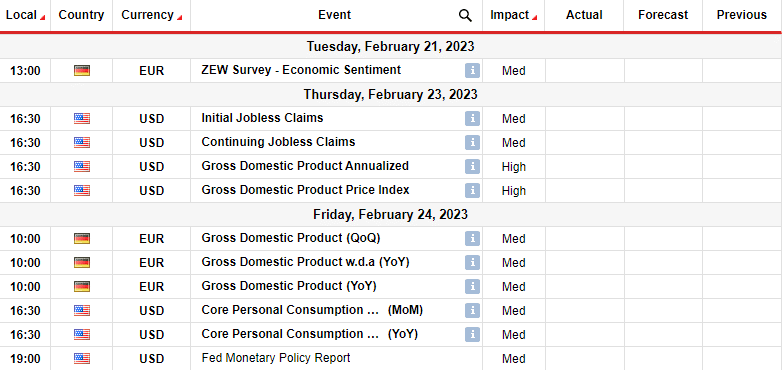

- Investors are awaiting GDP data from the US and the eurozone.

The EUR/USD weekly forecast is bearish as traders anticipate higher Fed rates for longer amid positive US economic data.

–Are you interested in learning more about STP brokers? Check our detailed guide-

Ups and downs of EUR/USD

The pair ended the week nearly flat on bets of more aggressive central banks in the US and the eurozone.

In contrast to projections for a 0.2% fall, Friday’s report revealed an annual gain in export prices of 0.8% in the US. On Thursday, data revealed lower-than-anticipated weekly unemployment benefit claims and increasing monthly producer prices in January. Wednesday saw the release of retail sales data that went up significantly, and CPI data on Tuesday showed persistent rising inflation.

The data, coupled with hawkish remarks from two Fed officials on Thursday and predictions for three additional Fed rate increases this year from Goldman Sachs and Bank of America, caused investors to prepare for further tightening.

Two key policymakers emphasized Friday that the European Central Bank’s interest rates still have room to rise. This increased market pricing for the peak rate and helped to dispel benign expectations from the previous policy meeting.

Next week’s key events for EUR/USD

GDP data from the eurozone and the United States next week will show economic growth in the two regions. The data will also show whether high interest rates negatively impact the major economies and the risk of recession.

The Fed monetary policy report will also draw a lot of attention as it will show reasons for the hike at the last meeting.

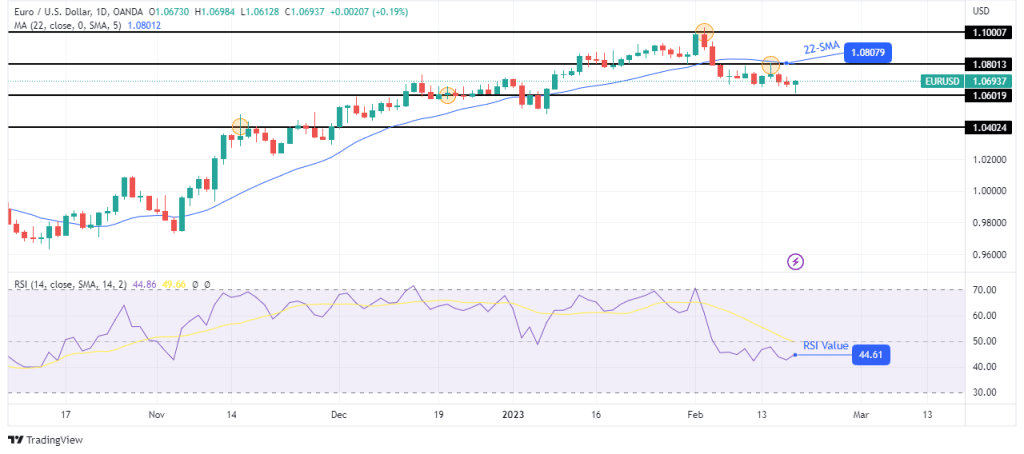

EUR/USD weekly technical forecast: Bears weaken below the 22-SMA

The daily chart shows EUR/USD trading below the 22-SMA, and the RSI below 50, a sign that bears have taken over after a strong bullish trend. Bears took over at the 1.1000 key resistance level and pushed the price below the 22-SMA.

–Are you interested in learning more about making money with forex? Check our detailed guide-

The previous trend was bullish, as seen in the RSI, which never went below the 50-mark. Although bears have taken over, they must push farther away from the SMA to show their strength. At the moment, the price is sticking close to the SMA and making small-bodied candles indicating weakness in the move.

If bears get stronger, the price will likely break below the 1.0601 support and head for the 1.0402 support.

Looking to trade forex now? Invest at eToro!

68% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money