- Eurozone inflation missed forecasts but still reached a record high of 9.9%.

- The US labor market remains tight, giving the Fed more room to raise rates.

- Investors expect the ECB to raise rates by 75bps.

The EUR/USD weekly forecast is bullish as markets await another massive rate hike from the ECB to fight rising inflation.

–Are you interested to learn more about ECN brokers? Check our detailed guide-

Ups and downs of EUR/USD

The pair had a bullish week. Data released on Wednesday revealed that consumer inflation in the eurozone was slightly lower in September than initially thought. Still, it remained incredibly high, reinforcing market expectations of further increases in interest rates before the year is through. Consumer prices in the 19 nations that share the euro increased 1.2% month over month for a 9.9% increase. Investors had expected inflation to hit 10%.

According to the Labor Department, the number of people applying for unemployment benefits for the first time in the US unexpectedly decreased last week. This gives the Fed more room to hike rates.

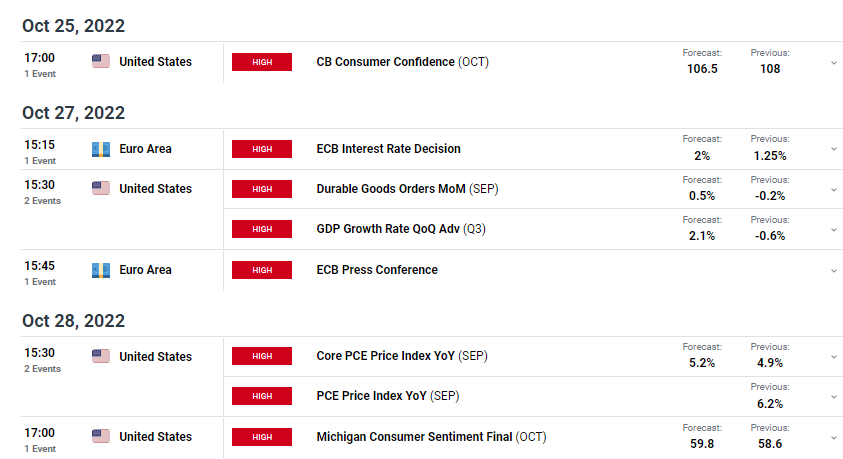

Next week’s key events for EUR/USD

On Thursday, the ECB is widely expected to announce its second large 75 basis-point rate hike. The ECB joined the global rate-hike party late, but in only two sessions, it has delivered increases totaling 125 basis points, the quickest rate of policy tightening in history.

Even though the possibility of a recession is increasing, there is little desire to slow down as the inflation rate in the euro area is close to 10% compared to the ECB’s aim of 2%. In the US, much weight is placed on the consumer confidence report.

EUR/USD weekly technical forecast: Bulls up against trendline resistance

Looking at the daily chart, we see the price trading above the 22-SMA and the RSI above 50, showing bulls are in charge. The bulls managed to make a higher low at the 0.9650 support level. They pushed the price off this level, broke above the 22-SMA, and retested it, confirming a shift in sentiment.

–Are you interested to learn more about making money in forex? Check our detailed guide-

However, bulls are now facing a strong trendline resistance level. If bulls gather enough momentum in the coming week, the price will likely break above the trendline and retest parity. This is where the market will decide whether the uptrend can continue as it is at a solid psychological level. If bulls can push above it, the price will be higher, confirming the uptrend.

Looking to trade forex now? Invest at eToro!

67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.