- Europe inflation enters double digits for September.

- Energy crises in Europe continue to falter the overall economy.

- ECB policy meeting and US NFP will be the focus next week.

The EUR/USD weekly forecast is bearish, as economic turmoil will likely grapple the European continent.

The see-saw continued

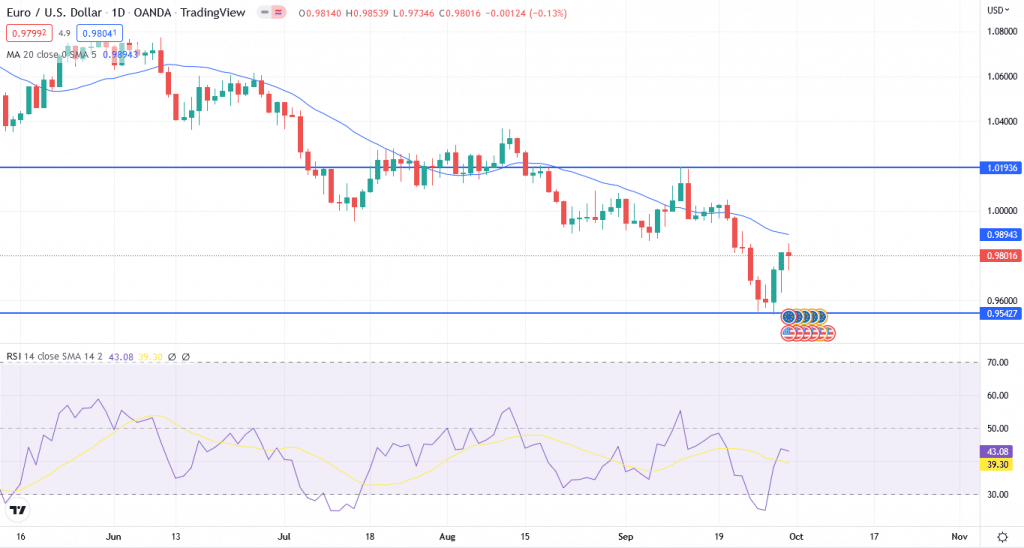

The EUR/USD pair began the week on the back foot, plunging to a new 22-year low of 0.9535 before reversing course mid-week to make significant gains and then resting around the 0.9780 level.

–Are you interested to learn more about AI trading brokers? Check our detailed guide-

US government bond rates plunged around 20 basis points as US indices fell to new 2022 lows. As a result of the declining rates, the overbought dollar began to plummet.

Next week’s key events for EUR/USD

According to preliminary figures, inflation in the Eurozone hit 10% and a new record high in September. The negative impacts of Russia’s war in Ukraine continue to weigh heavily on European economies.

The most recent price increase was driven by electricity, which is now 40.8% more expensive than it was in the same month last year.

The new Eurozone inflation data will also likely pressure the European Central Bank (ECB) to raise interest rates further.

The Organization for Economic Co-operation and Development (OECD) stated earlier this week that winter energy outages may force several nations across Europe, including Germany, into “a full-year recession in 2023.”

The annual inflation rate in the United States fell for the second month to 8.3% in August 2022, the lowest in four months, from 8.5% in July but above market expectations of 8.1%.

More than expected, inflation encouraged risk-averse trade, pushing the stock market down and yields up, allowing the USD to rebound further ahead of the weekly close.

–Are you interested to learn more about Canada forex brokers? Check our detailed guide-

EUR/USD Weekly Technical Forecast: The bearish momentum stays intact

EUR/USD traded up on Friday and hit the 0.9853 level before closing the week at 0.98016.

The pair is way below its 20-day moving average on the daily chart, and the RSI is above the 40 level.

EUR/USD is now hitting the 0.9853 level. A fall below 0.9685 can bring the pair towards the 0.9600 support level. If the pair dips below this level, it will move to the next support level at 0.9536, the level it reached on September 28.

On the upside, the pair can reach the next resistance level, around 0.9907. A break over 1.0050 will pave the door for a test of the following resistance level of 1.0187.

Looking to trade forex now? Invest at eToro!

68% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.