- Eurozone inflation rose to 8.9%.

- Investors expect a drop in US nonfarm payrolls.

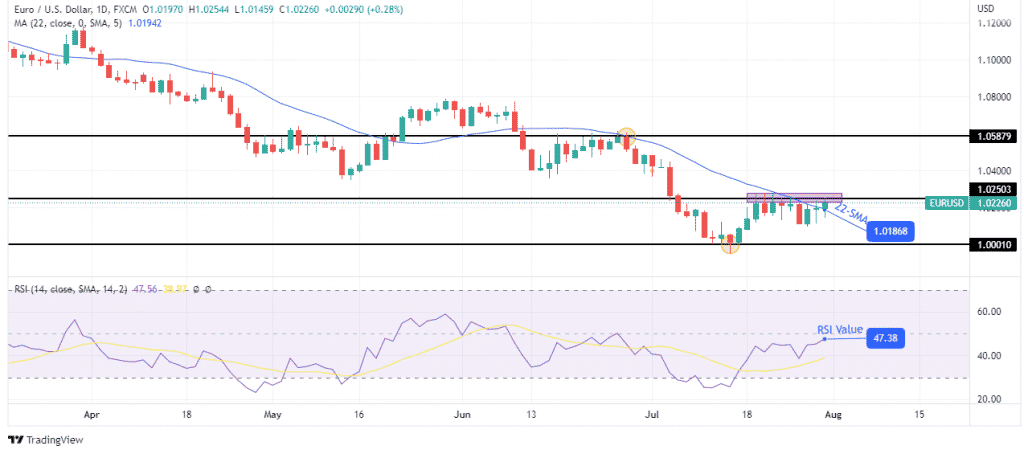

- The pair is facing strong resistance at 1.02503.

The weekly EUR/USD forecast is slightly bearish as dollar weakness is not enough to push the pair higher with an economic crisis in Europe.

–Are you interested to learn more about low spread forex brokers? Check our detailed guide-

The ups and downs of EUR/USD

The pair closed the week slightly higher with a small-bodied weekly candle showing there were mixed reactions to the news releases over the week. The move up was mainly caused by the weakness in the US dollar after disappointing US data showed a slowdown in the economy.

The US dollar also lost ground after the FOMC meeting, where Powell came off as less hawkish than investors had feared. Markets seized on this as a possibility that the Federal Reserve would loosen its tight policy. All these developments helped support the EUR/USD.

However, this move up was capped by the crushing eurozone economy. Several things have been ailing the region this past week, including political instability in Italy, the ever-growing gas crisis, and the red hot 8.9% inflation rate. All these things played a role in dragging the pair down.

Next week’s key events for EUR/USD

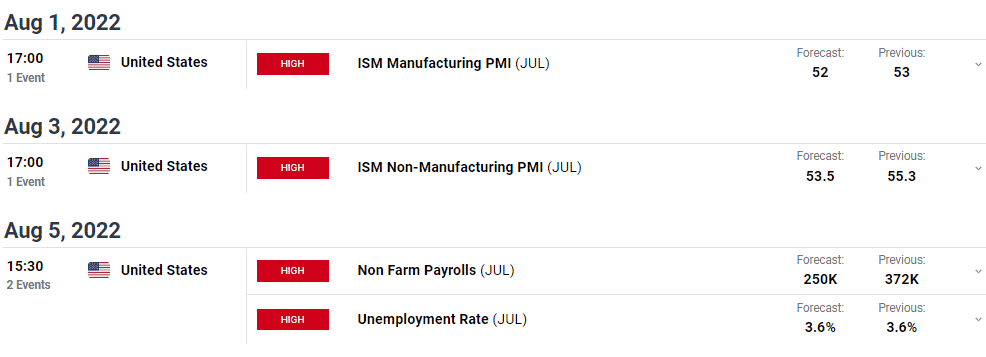

As the US nonfarm payroll data will be released, EUR/USD investors are in for some high volatility next week. The unemployment rate is expected to hold at 3.6%, while nonfarm payrolls are expected to drop from 372K to 250K.

Data released from the US last week showed a higher risk of a recession. If the nonfarm payrolls come in lower than the forecasts, it would be another reason for the Federal Reserve to loosen its monetary policy. Such an occurrence would cause a rally in the pair.

EUR/USD weekly technical analysis: Bulls need to break above 1.02503 to confirm an uptrend.

The daily chart shows the price at a very important level. The bulls have been trying to break above 1.02503 since July 19. However, this level has held strong. The RSI trades below 50 and shows bears are still in charge. At the same time, the price is on the cusp of breaking above the 22-SMA, showing a looming shift in sentiment.

–Are you interested to learn more about forex bonuses? Check our detailed guide-

If 1.02503 holds as resistance, the price might retest parity, while a break above could hit the June 28 resistance at 1.05879.

Looking to trade forex now? Invest at eToro!

67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.