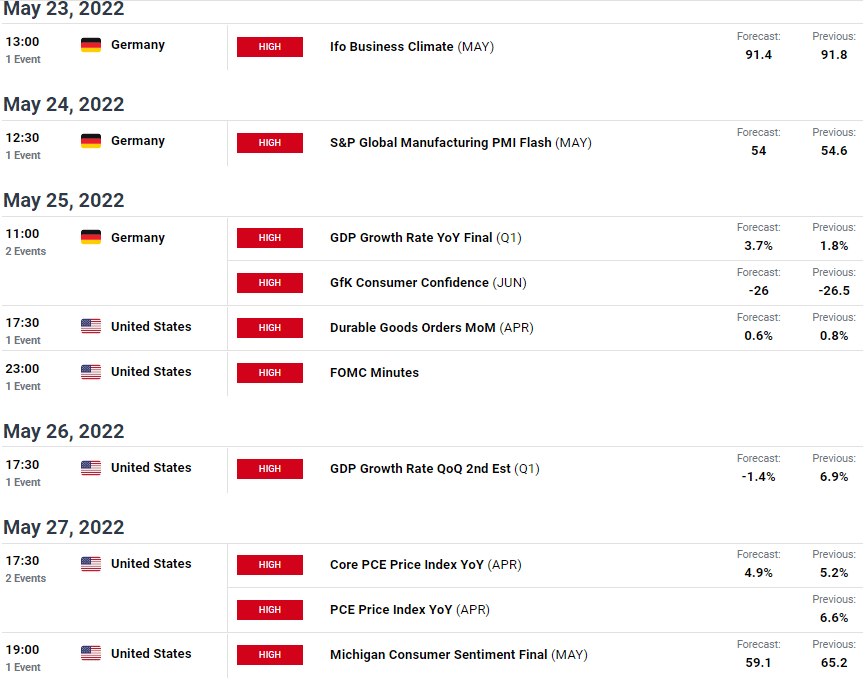

- The FOMC meeting minutes could make EUR/USD volatile.

- The European Central Bank is expected to start raising interest rates.

- The US GDP is expected to hold at -1.4%.

The EUR/USD weekly forecast remains slightly positive as the price closed on a bullish candle this past week. It was a week full of activity. Now, we dive in and look at some of the things that made the pair move.

–Are you interested in learning more about British Trade Platform Review? Check our detailed guide-

Ups and downs of EUR/USD

On Tuesday, we were able to look into consumer spending with the release of the core retail sales data in the US. From a previous value of 2.1%, investors had expected the value to come down to 0.4%, showing a slowdown in the economy. Although the value came higher than expected at 0.6%, it was still down from the previous 2.1% and bearish for the dollar.

The European Central Bank is also expected to follow in the footsteps of the Federal Reserve by hiking interest rates for the first time in nearly a decade. The ECB has been playing the wait-and-see game for quite some time now. However, in recent months, rate hike expectations have increased, as has inflation. The possible rate hike gave EUR/USD bulls a bit of hope, pushing the pair up. Whether this will go on next week is what we wait to see.

On the other hand, Fed chair Powell on Tuesday restated their mission to see inflation back at the US central bank’s 2% target. As a result, investors expect to see more rate hikes in the coming months.

What awaits EUR/USD in the coming week?

Investors will be paying attention to the FOMC meeting minutes, which will come out on Wednesday. It is, however, not a secret that the Fed remains hawkish. Therefore, the minutes are expected to align with the Fed’s opinions on rate hikes.

Investors will also be looking at US GDP data, which will come out on Thursday. GDP is a primary indicator of the economy’s health. It is expected that GDP q/q will remain at -1.4%. Anything lower would be bearish for the dollar, pushing the EUR/USD higher.

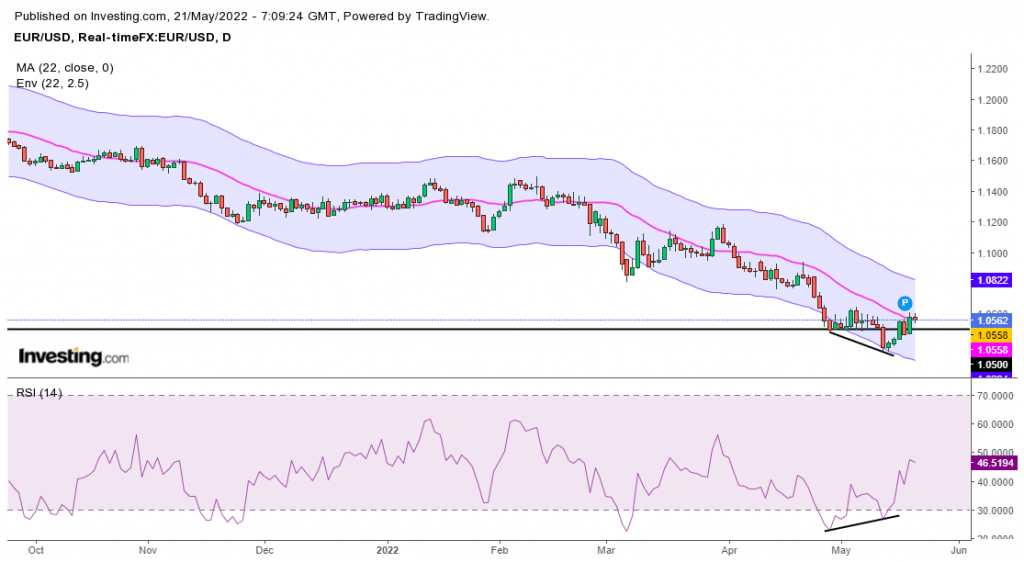

EUR/USD weekly technical forecast: Bullish divergence in play

Looking at the daily chart, we can see that prices have been trading below 22-SMA for some time now. This move shows that the bears have been in control.

–Are you interested in learning more about buying NFT tokens? Check our detailed guide-

Currently, the price is right at the 22-SMA, which has earlier acted as resistance. Therefore, it might bounce off and continue moving lower. On the other hand, RSI shows a bullish divergence that a clean break of the 22-SMA would only confirm. Therefore, the bias will only turn bullish if we can start seeing RSI above the 70 level.

Looking to trade forex now? Invest at eToro!

68% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money