- The Federal Reserve may facilitate a smooth economic landing.

- The US economy grew rapidly in the fourth quarter.

- Investors are expecting the Fed to deliver a 25bps rate hike.

The EUR/USD weekly forecast is slightly bearish as easing US inflation and a resilient economy could mean a soft landing by the Fed.

Ups and downs of EUR/USD

On Friday, slowing inflation data fueled hopes that the Federal Reserve may facilitate a smooth economic landing and scale down its aggressive monetary tightening next week. As a result, the dollar crept up from eight-month lows.

–Are you interested to learn more about day trading brokers? Check our detailed guide-

According to a report from the Commerce Department, US consumer spending declined for the second consecutive month in December. The data also revealed the weakest increase in personal income in eight months, largely due to moderate wage growth – both good signs for inflation.

On Thursday, the dollar went up slightly against the euro after data revealed that the US economy grew quickly in the fourth quarter, bolstering the case for the US Fed to maintain its hawkish stance.

The last quarter saw an annualized growth in the US gross domestic product of 2.9%.

Next week’s key events for EUR/USD

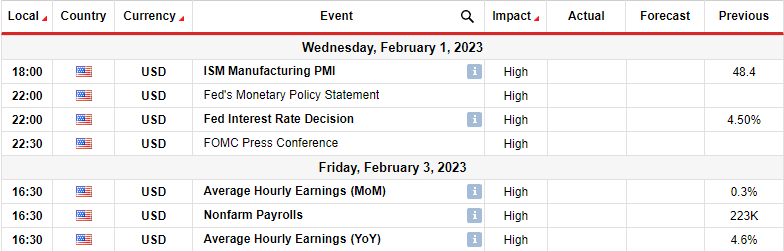

Investors expect important news from the US in the coming week, including the FOMC interest rate decision and the nonfarm payrolls report.

Jerome Powell, the chair of the Fed, has made it abundantly obvious that the central bank’s fight against decades-high inflation is far from done. Financial markets anticipate the central bank will raise the Fed funds target rate by 25 basis points following its policy meeting next week.

EUR/USD weekly technical forecast: Imminent pullback to the 22-SMA

The daily chart shows EUR/USD in a bullish trend, with the price trading above the 22-SMA and the RSI above 50. However, the price is also close to the 22-SMA, which signifies that bulls are not fully committed to increasing the price.

–Are you interested to learn more about forex signals? Check our detailed guide-

The price has paused at the 1.0901 resistance, and bears have returned. This could mean a pullback in the coming week to retest the 22-SMA. The SMA support coincides with the bullish trendline, making it a strong support zone.

If bears break below this zone, the price will likely fall to the next support at 1.0503. However, if bulls hold on to control, the price will bounce higher, retest, and probably break above the 1.0901 resistance.

Looking to trade forex now? Invest at eToro!

67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.