EUR/USD is swiftly recovering ground above 1.2100, as the US dollar corrects its recent rally to weekly highs. Investors resort to profit-taking on the USD longs ahead of all-important US Retail Sales and Consumer Sentiment data. Meanwhile, the Fed’s policymakers continue to see rising inflation as transitory, weighing negatively on the US Treasury yields while aiding EUR/USD’s bounce.

How is EUR//USD positioned on the technical graphs?

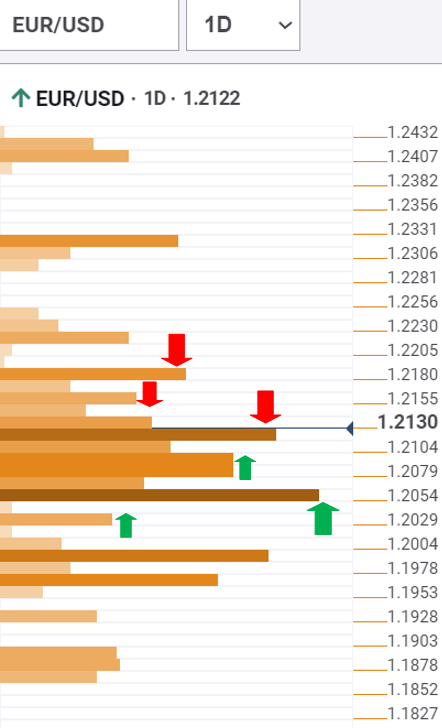

EUR/USD Price Chart: Key resistance and support levels

The Technical Confluences Detector shows that EUR/USD is threatening powerful resistance at 1.2130, which is the convergence of the SMA100 one-hour, SMA5 one-day and Fibonacci 23.6% one-week.

If the buyers find a foothold above the latter, the previous month highs of 1.2150 could be on their radars.

The next relevant barrier awaits at 1.2180, the confluence of the previous week high and Bollinger Band one-day Upper.

On the flip side, if the bears fight back control, the EUR/USD pair could turn south once again, in order to test a dense cluster of strong support levels around 1.2090-80.

That zone is the intersection of the Fibonacci 61.8% one-day, SMA10 one-day and Bollinger Band one-day Middle.

Should the bearish momentum gain traction, it will be critical for the bulls to hold onto the crucial support around 1.2060, where the SMA100 one-day, the previous day low and Fibonacci 23.6% one-month coincide.

The 1.2030 cushion will be the last line of defense for the EUR bullish traders. At that point, the Fibonacci 161.8% one-day meets with the pivot point one-day S2.

Here is how it looks on the tool

About Technical Confluences Detector

The TCD (Technical Confluences Detector) is a tool to locate and point out those price levels where there is a congestion of indicators, moving averages, Fibonacci levels, Pivot Points, etc. Knowing where these congestion points are located is very useful for the trader, and can be used as a basis for different strategies.