- Dovish Fed pushed the yield differentials lower in favor of the common currency, sending EUR/USD to multi-week highs near 1.1440.

- Markets may have priced in the Fed rate hike pause over the last three months. The USD, therefore, could make a comeback on “buy the fact” trade.

EUR/USD jumped to 1.1440 on Wednesday, the highest level since Feb. 4, as Fed’s dovish tone pushed the treasury yields down to year lows.

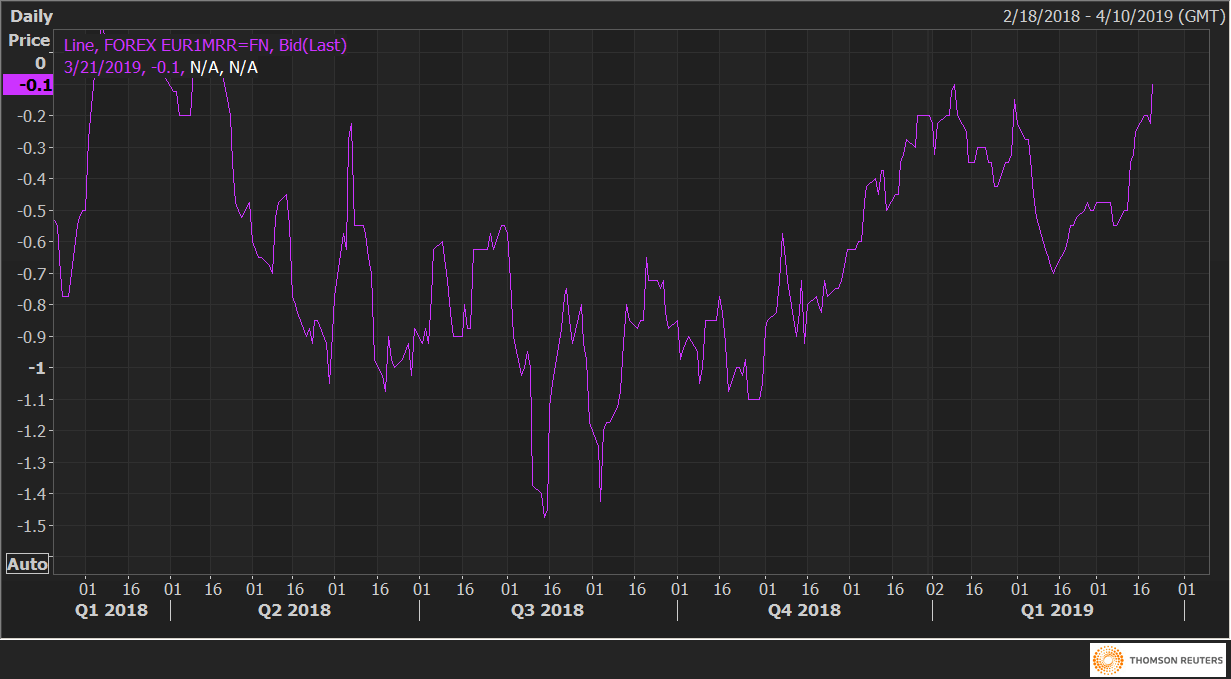

Notably, the spread between the US and German two year bund yields fell to 293 basis points, the lowest level since April 2018. Further, one-month 25 delta risk reversals rose to a three-month high of -0.10, indicating a weakening of bearish bias. (A reading above zero indicates bullish bias).

So, the path of least resistance appears to be on the higher side. Validating that argument is the pair’s bullish close above the trendline connecting the Jan. 10 and Jan. 31 highs.

That said, markets have been turning up the heat on the Fed to dial back rate hikes since early December. Put simply, the pause signaled by the Fed yesterday may have been priced in. After all, the two-year yield spread is currently down more than 60 basis points from the highs of 358 basis points seen in early November.

Therefore, the greenback may regain composure on “buy the fact” trade, pushing the EUR/USD back to the ascending 5-day MA, currently at 1.1370.

As of writing, the spot is trading at 1.1423.

Technical Levels

Resistance: 1.1448 (previous day’s high), 1.1490 (200-day moving average), 1.1514 (Jan. 31 high)

Support: 1.1369 (5-day moving average), 1.1355 (50-day moving average), 1.1315 (200-hour moving average)

US-German two-year yield spread

One-month 25-delta risk reversals