EUR/USD is currently trading at 1.2300 on the nose at the time of writing, having travelled from a low of 1.2265 to a fresh cycle high of 1.2349.

The bearish dollar theme is still in play and risk on has been fuelled by a resurgence in global manufacturing as shown in various surveys this week despite the rising coronavirus cases.

With markets anticipating a Democrat win in the US Senate election in Georgia that would clear the path for a larger fiscal stimulus package, the greenback was under pressure.

Democrats won one US Senate race in Georgia and led in another on Wednesday, moving closer to a sweep in a deep South state. Control of Congress will power President-elect Joe Biden’s policy goals.

The stock market has reacted in kind and taken the opinion that a Democrat-controlled Senate would be positive for economic growth globally and thus for most riskier assets.

For currencies, the result will embolden the negative bond market theme and subsequently pressure the greenback considering the US budget and trade deficits will swell even further.

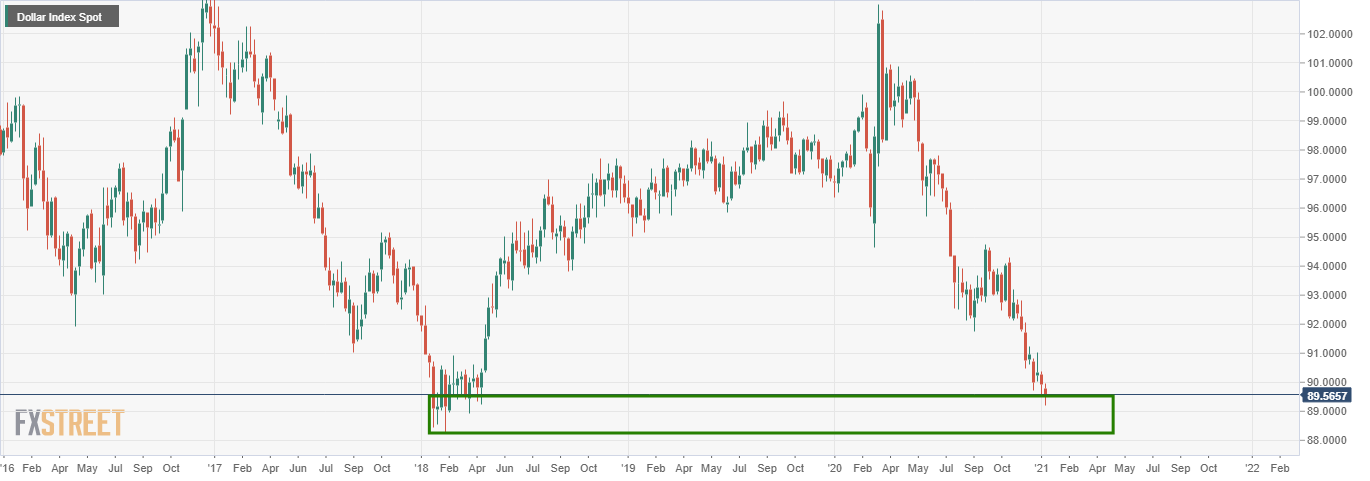

As markets priced in the Democrats winning both seats, the DXYfell to its lowest since March 2018 at 89.206.

DXY weekly chart

Additionally, fueling expectations of further stimulus measures was a weak report on US jobs, a potential prelude to this Friday’s Nonfarm Payrolls.

The ADP National Employment Report has proven that private payrolls post their first decline in eight months as coronavirus cases surge.

Where to from here?

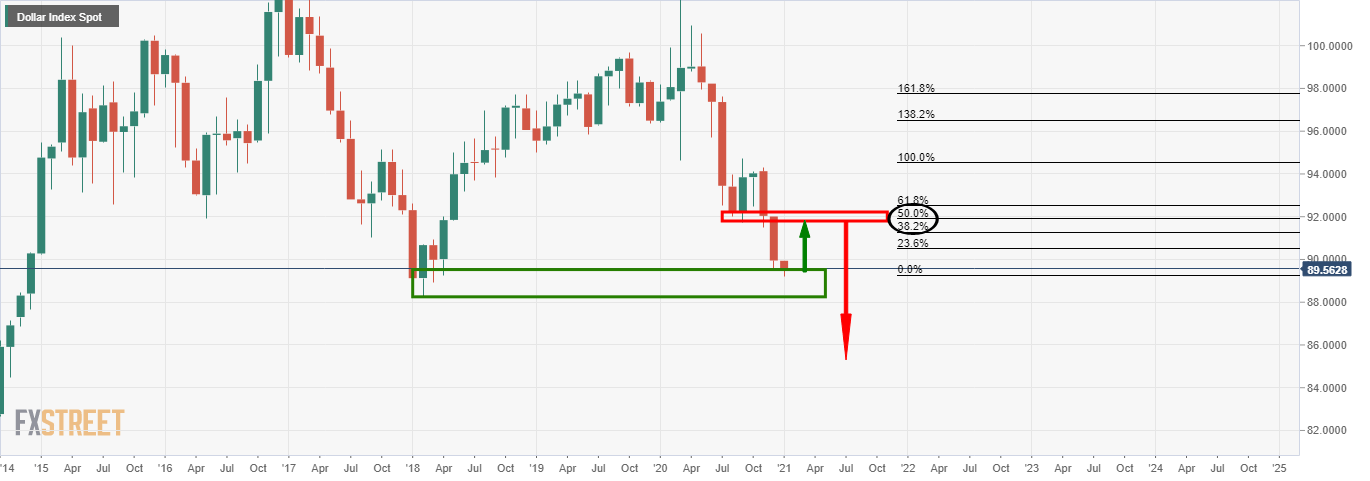

From a technical point of view, there could be some consolidation in the DXY considering how stretched the US dollar is from a monthly basis:

Where the dollar goes, the euro will follow. However, while holding the 10-day moving average, the bulls will remain in the driving seat.

As can be seen, the price is testing the prior resistance which now acts as support, reinforcing the upside bias above the 10-day moving average and trendline support.

However, failures to hold above this support will pressure bullish commitments around the 10-day dma and trendline support. A break this confluence will likely reinforce the upside corrective technical bias in the US dollar.

Fundamentally, what investors are trying to figure out is how quickly the Democrats would be able to introduce their tax and stimulus agendas.

Dragging of feat will likely give the US dollar some breathing room.

Moreover, the fluidity in the coronavirus situation is a major risk factor for markets and the dollar could be rescued on a safe haven bid at times of deteriorating risk appetite.

Meanwhile, the perception that the European Central Bank may not have the ammunition to avoid extremely low inflation levels could keep the single currency underpinned.

Conversely, the Federal Reserve is ontrack to “increase our holdings of Treasury securities by at least $80 billion per month and of agency mortgage-backed securities by at least $40 billion per month.”

-637455528616615235.png)