The Euro moved lower against the Canadian dollar yesterday, but later managed to hold ground around the 1.4100 support area. The EURCAD pair looks like forming a short-term bottom for a move higher towards the 1.4240 level. The German Gfk Consumer Climate Index was released earlier today, which fell a bit more than expected. The German Gfk Consumer Climate Index was down from 8.6 to 8.3, which is 0.2 points more than the market expected. However, the Euro somehow managed to survive losses after the release. The EURUSD pair was seen consolidating in a 20 pip range since the start of the London session.

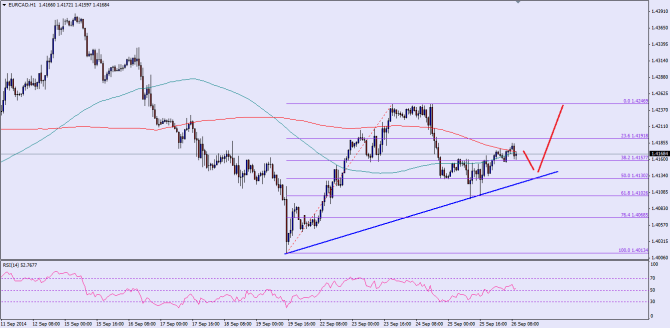

There is a major bullish trend line on the hourly chart of the EURCAD pair, which acted as a support for the pair recently. Moreover, the 61.8% Fibonacci retracement level of the last leg from the 1.4013 low to 1.4246 high was also sitting around the mentioned trend line. So, we can say that the bounce came from a very technical level. Currently, the pair is trading around a critical confluence area of 100 and 200 simple moving averages. If the pair succeeds in closing above the stated confluence area, then it would open the doors for a move towards the last high of 1.4240. Any further gains might take the pair towards the 1.4300 level.

The hourly RSI is above the 50 level, which supports the bullish view as of now. On the other hand, if the pair moves lower from the current levels, then it might find buyers around the highlighted trend line.

Overall, buying dips around the 1.4120 level is a good option as long as the trend line holds.

————————————-

Posted By Simon Ji of IKOFX