The Euro was seen trading higher against the Canadian dollar yesterday, but it struggled to break a key resistance area around the 1.4145 level. There were a couple of economic releases scheduled during the London session, including the German and Euro zone services PMI. The German services PMI came better than expected, and registered a rise from 54.9 to 55.5. The Euro zone services PMI was released next, which came as a disappointment and declined from 53.1 to 52.4. The Euro was seen struggling against the US dollar after the release, and the EURCAD pair was not affected as much as it should have.

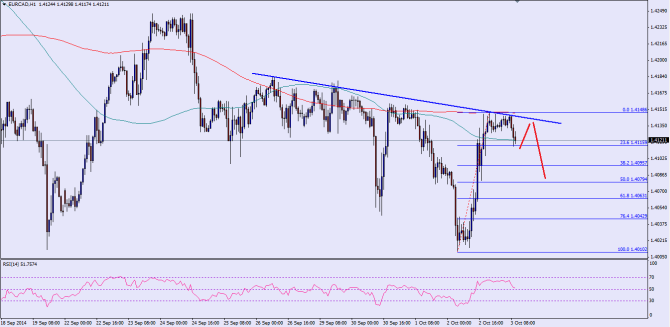

There is a critical bearish trend line formed on the hourly chart of the EURCAD pair, which is acting as a barrier for the pair. The most important point to note here is that the 200 hourly moving average is sitting right around the mentioned trend line, which means the Euro buyers might face a tough time to break the 1.4145 level. Currently, the pair is testing the 23.6% fib retracement level of the last leg from the 1.4012 low to 1.4148 high. So, there is a chance that the pair might bounce from the current levels towards the highlighted resistance area one more time. It would be interesting to see how it reacts in that situation.

If the pair fails to break the 1.4145 level, then it might dive towards the 50% fib retracement level which is currently around the 1.4079 level.

Overall, one might consider selling right around the 200 hourly moving average with a stop above the trend line resistance area.

————————————-

Posted By Simon Ji of IKOFX