The Euro sellers continued to gain pace not only against the US dollar, but also against the Japanese yen. The EURJPY pair traded below the 127.00 support area recently where the Euro sellers were seen struggling. There is a chance that the EURJPY pair might recover in the near term, but the upside might be limited considering the amount of bearish pressure is on the EURJPY pair. There are no major releases lined up in the Euro zone and Japan today. So, the pair might trade based on the market sentiment in the short term. We need to see how the sellers react if the Euro manages to move higher from the current or a bit lower levels.

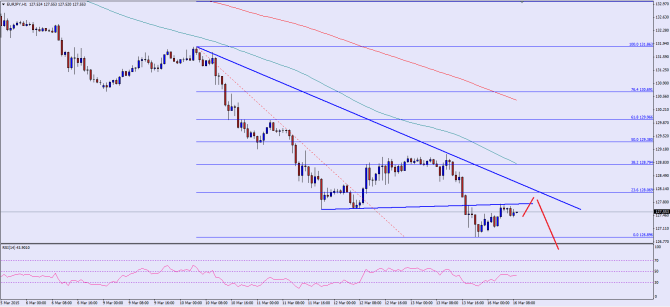

There is a monster bearish trend line formed on the hourly chart of the EURJPY pair, which is likely to act as a catalyst for the pair moving ahead. There is one more point to note is that there was a bullish trend line on the hourly chart, which was breached recently and opened the doors for more downsides in the near term. Now, both the trend lines are coinciding around the 128.00-20 resistance area, which holds a lot of importance. The 23.6% fib retracement level of the last leg from the 131.86 high to 126.89 low is also sitting around the same area, which increases the importance of the 128.20 level.

If the EURJPY pair fails to move higher and trades back lower, then the last low of 126.89 level might come into play again.

Overall, one might consider selling rallies in the EURJPY pair as long as it stays below the 128.20 level.

————————————-

Posted By Simon Ji of IKOFX Technical Team: Online Forex Broker

Website: http://ikofx.com/

In our latest podcast, we discuss QE: Who got it right, Krugman or the Gold bugs?