The Euro had no relief against the US dollar, but it managed to gain bids against the Japanese yen. This has less to do with the Euro’s strength and more to do with the Japanese yen weakness. The EURJPY traded higher and broke an important resistance zone to challenge the 100 hourly moving average. The Spanish retail sales data was released earlier during the London session, which exceeded the market’s expectation and registered an increase of 0.4%. This might help the EURJPY pair in the short term.

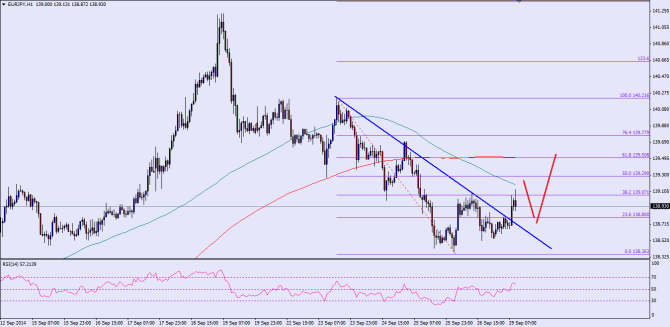

There was a bearish trend line on the hourly chart of the EURJPY pair, which was breached earlier during the London session. Moreover, the pair also broke the 23.6% fib retracement level of the last drop from the 140.21 high to 138.36 low. Currently, the pair is struggling to break the 38.2% fib retracement level and 100 moving average, which is at 139.18. There is a chance that the pair might correct lower from the current levels, retest the broken area and then climb higher again. So, on the downside, the 138.80 level might play a pivotal area in the near term where the Euro buyers are likely to appear. A break below the mentioned level might take it towards the 138.40 support area.

On the upside, a break and close above the 100 moving average could take the pair towards the 200 moving average, which is right around the 61.8% fib level. So, the 139.50 level might act as a swing zone for the pair.

Overall, buying dips around the 138.80 level might be considered as long as 138.40 hold.

————————————-

The Euro had no relief against the US dollar, but it managed to gain bids against the Japanese yen. This has less to do with the Euro’s strength and more to do with the Japanese yen weakness. The EURJPY traded higher and broke an important resistance zone to challenge the 100 hourly moving average. The Spanish retail sales data was released earlier during the London session, which exceeded the market’s expectation and registered an increase of 0.4%. This might help the EURJPY pair in the short term.

There was a bearish trend line on the hourly chart of the EURJPY pair, which was breached earlier during the London session. Moreover, the pair also broke the 23.6% fib retracement level of the last drop from the 140.21 high to 138.36 low. Currently, the pair is struggling to break the 38.2% fib retracement level and 100 moving average, which is at 139.18. There is a chance that the pair might correct lower from the current levels, retest the broken area and then climb higher again. So, on the downside, the 138.80 level might play a pivotal area in the near term where the Euro buyers are likely to appear. A break below the mentioned level might take it towards the 138.40 support area.

On the upside, a break and close above the 100 moving average could take the pair towards the 200 moving average, which is right around the 61.8% fib level. So, the 139.50 level might act as a swing zone for the pair.

Overall, buying dips around the 138.80 level might be considered as long as 138.40 hold.

————————————-

Posted By Simon Ji of IKOFX